Deloitte Tax Championship 2023

Background:

The Deloitte Tax Championship (DTC) is an annual case competition for students to demonstrate their expertise in China Tax and International Tax. The competition aimed to provide an opportunity for students to develop comprehensive tax strategies, critical thinking, analytical reasoning, and problem-solving skills while demonstrating an in-depth understanding of complex tax regulations to a panel of judges.

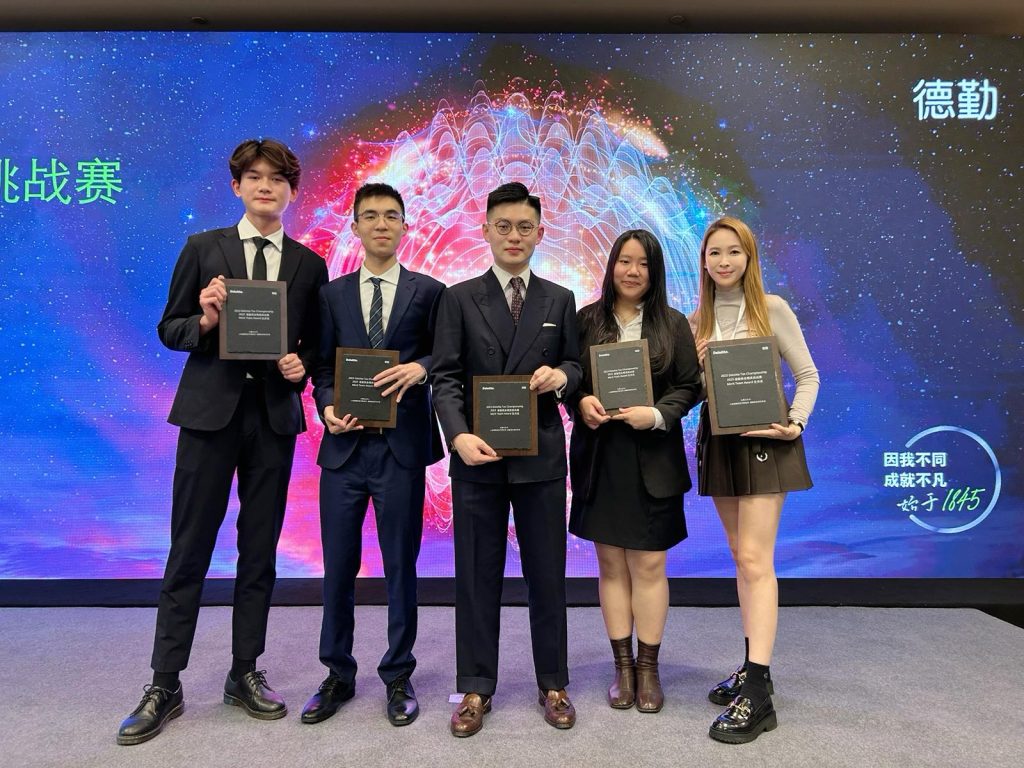

This year’s competition consisted of three rounds, including a Preliminary Round, National Semi-final, and Final Round. The HKU team excelled and advanced to the National Round, where they competed in a simulated case held in Chongqing and brought home the Merit Team Award.

Website / Image URL:

2023德勤税务精英挑战赛初赛圆满结束 | 德勤中国 (deloitte.com) (Chinese version only)

https://ug.hkubs.hku.hk/competition/deloitte-tax-championship-2023

Award(s):

Merit Team Award in the National Round

Top 3 in the Regional Round

Faculty Advisors and Awardees:

| Dr. Jasmine Kwong | Dr. Christina Ng |

|  |

| Mr. Lau Chun Ho Darren, BBA(Acc&Fin), Year 5 (Team Leader) Mr. Cheng Ting Cheung, BBA(Acc&Fin), Year 3 Ms. Choi Yu Hei, BEcon&Fin, Year 2 Mr. Ngan Tsz Ho, BFin(AMPB), Year 2 |

Students Sharing:

“Never in my wildest dreams would I imagine myself getting into the national round of the competition twice, and I am privileged to have formed a group with four extraordinary teammates. Before joining this competition, past participants of DTC Annie had already told me that this competition was going to be really tough and mentally draining. It was way more complicated than we expected. The four of us still had the guts to challenge ourselves and gave it a try.

I want to thank the Faculty Advisors, Dr. Christina Ng and Dr. Jasmine Kwong, for all the support you have given to our team. You two were our backbone. Thank you for the ongoing support throughout the entire journey. Without you both, we would not have been able to come this far and achieve such remarkable results.

I also want to thank the faculty administrative staff, Kit and Joanne for the continuous support throughout the competition. You two are always the unsung heroes of our faculty. You are super helpful in guiding and taking care of all of us. Without you, the journey would not have been so smooth.

I want to express my gratitude to my teammates, Jason, Cherry, and Howard for their hard work and devotion to the competition. We have formed an unbreakable bond and lasting friendships. One of the adjudicators came to find Howard during the ceremony and mentioned that he outperformed other candidates in the ESG (Environmental, Social, and Governance) part as he provided an in-depth evaluation of its underlying principles, delineating all three key components. I can still vividly remember the smiling faces of those who made me feel so proud of Howard. Also, I would like to thank Cherry, our mastermind, who is truly skilled at making PowerPoint slides. Lastly, I would like to thank Jason for his hard work in handling the most technical questions and calculations.

Once again, I would like to reiterate that having the courage to take up this challenge is already a great leap towards success. We have an iron-willed spirit with unwavering commitment and unswerving dedication to the competition, allowing us to withstand the pressure of analyzing lengthy case materials in three hours and delivering a speech in front of adjudicators and teachers from other schools.

“The process is more important than the result.” We all enjoyed the competition moments, particularly the impromptu queries from the adjudicators. They understood that Hong Kong has a simple tax structure and we are not that familiar with China tax and transfer pricing, so they did not pose strong challenges related to those issues. Instead, they provided us with guidance to help us interpret the case questions.”

(By LAU Chun Ho Darren)

“From the moment our team decided to participate in the tax competition, I felt a surge of excitement mixed with a tinge of nervousness. As the designated expert in technical matters, I knew that I would play a crucial role in our team’s success. With unwavering determination, I dove into an intensive phase of preparation, immersing myself in tax laws, regulations, and case studies.

Deloitte Tax Championship is definitely a challenging and demanding case competition which examines contestants’ practical knowledge of China tax and international tax strategies. As Hong Kong undergraduate students, we receive less training and education in China tax than universities from mainland, but our team still demonstrated strong logical thinking and commercial awareness in the competition. Therefore, we achieved distinctive results in the Regional Preliminary Round and won the Merit Team Award in the National Round.

Participating in the tax competition pushed me beyond my comfort zone and expanded my technical expertise in ways I never imagined. It provided me with an opportunity to refine my critical thinking skills, improve my problem-solving abilities, and deepen my understanding of tax laws and regulations.

Moreover, the experience taught me the value of continuous learning and self-improvement. I recognized areas where I could further enhance my technical knowledge and have since been actively seeking opportunities to broaden my understanding of tax concepts.

I would like to take this opportunity to thank Dr. Christina Ng and Dr. Jasmine Kwong for their ongoing support and guidance throughout the competition. Not only do they provide training given their tight teaching schedule, they also spend their personal time to support us in the national round in Chongqing. Their support is definitely an inevitable part of our team’s success.”

(By CHENG Ting Cheung Jason)

“Participating in the tax competition has been an unforgettable experience for me, symbolizing our dedication to academic excellence and the pursuit of knowledge. We have demonstrated invaluable critical thinking, analytical reasoning, and problem-solving skills, which are essential for navigating the complex world of taxation.

From the beginning, our participation in the tax competition was driven by a shared ambition to excel and a desire to test our knowledge and skills in the field of taxation. Our team, comprised of passionate students, embarked on a rigorous preparation process that included studying tax laws, analyzing case studies, and engaging in mock simulations.

The competition itself was a rigorous test of our expertise, critical thinking abilities, and problem-solving skills. We were required to develop comprehensive tax strategies, demonstrate an in-depth understanding of complex tax regulations, and convincingly present our findings. Our team’s meticulous attention to details, innovative approaches, and ability to think on our feet contributed significantly to our success.

Lastly, I must express my sincere gratitude for the generous help and comprehensive teaching on taxation that I received from Dr. Christina Ng at HKU Business School. This achievement would not have been possible without the unwavering support of our school, the guidance of our faculty advisors, and the collective effort of our team members.”

(By CHOI Yu Hei Cherry)

“Reflecting on my journey through the national tax competition, I am filled with a profound sense of humility and gratitude. This experience has been an incredible learning opportunity, allowing me to delve deeply into the complexities of taxation, a field that is both challenging and immensely rewarding.

A moment that stands out for me was when an adjudicator recognized my work on the ESG (Environmental, Social, and Governance) component. Their acknowledgment of my ability to effectively analyze and evaluate these intricate topics was unexpected and deeply affirming. The memory of their smile is a poignant reminder of the value of hard work and the importance of a thorough understanding of such critical issues.

The courage and determination that my team and I displayed in taking on this challenge were remarkable. We were united by our commitment to excel, facing the intense pressure of analyzing extensive case materials in a limited timeframe and presenting our findings in a high-stakes environment.

I particularly embraced the philosophy that “process is more important than the result.” This mindset enriched every aspect of the competition for me, especially when responding to impromptu questions from the adjudicators. Their understanding of our background and their guidance in areas like China tax and transfer pricing, which were less familiar to us, were immensely helpful.

The competition was as demanding and intense as I had anticipated, yet incredibly rewarding. I am grateful for the chance to have worked with a group of extraordinary teammates. Our collective strengths, united by a common goal to learn and succeed, made this experience not just a competition, but a journey of growth and discovery.

In writing this article, I am reflecting not only on the achievements but also on the journey itself. It is a story that underscores the importance of humility, the strength of teamwork, and the vast potential that lies in embracing challenges with an open mind and a willing heart.”

(By NGAN Tsz Ho Howard)