Latest Research Publications

Research Insights

Global Scholars

Impact Stories

HKEJ Column

FT Chinese Column

In the Media

Mutual funds investing in illiquid corporate bonds actively manage Treasury positions to buffer redemption shocks. This liquidity management practice can transmit non-fundamental fund flow shocks onto Treasuries, generating excess return volatility. Consistent with this hypothesis, we find that Treasury excess return volatility is positively associated with bond fund ownership, and this pattern is more pronounced among funds conducting intensive liquidity management. Causal evidence is provided by exploiting the U.S. Securities and Exchange Commission’s 2017 Liquidity Risk Management Rule. Evidence also suggests that the COVID-19 Treasury market turmoil was attributed to intensified liquidity management, an unintended consequence of the 2017 Liquidity Risk Management Rule.

February 2025

The Review of Financial Studies

The Interactions of Customer Reviews and Price and Their Dual Roles in Conveying Quality Information

Customer reviews help communicate product information, but their effectiveness may suffer from selection bias (i.e., depending on factors, such as the individual experience and price, not all consumers may voluntarily write reviews). Consequently, a seller may have to resort to additional means (e.g., signaling through price in the context of an experience good) to convey its quality. This paper develops an analytical model to investigate the interaction of customer reviews and price with the presence of selection bias in marketing an experience good with uncertain quality to consumers. Our analysis reveals the dual roles played by both customer reviews and price in communicating quality information. On one hand, customer reviews may either directly convey product information with unbiased distribution of reviews or facilitate price signaling when reviews are biased because of selection. On the other hand, price may be adjusted to mitigate the selection bias of reviews to make them more informative, and it may also signal quality directly in the presence of review bias. As a result, we show that bias in reviews may actually benefit consumers without compromising information communication as the incentive to reduce review selection bias makes it credible and profitable for the high-quality seller to signal its type by undercutting the price that would be set if it is of low quality. We then extend our analysis to examine the information, profits, and welfare impacts of several important design elements of a review system as well as the impact of consumers’ aversion to risk. Finally, the implications of our findings on the management of user-generated content and pricing are discussed.

January-February 2025

Marketing Science

Short selling regulation has been a longstanding topic of debate in financial markets, particularly during times of crisis. While proponents argue that short selling aids in price discovery and market efficiency, critics raise concerns about manipulative short selling practices that can destabilize markets. This paper presents a theoretical model to analyze the impact of short selling, specifically manipulative short selling (MSS), on bank runs and efficiency. The model demonstrates that MSS can emerge as an equilibrium outcome driven by uninformed speculators seeking to profit from artificially depressing stock prices. The prevalence of MSS is influenced by the level of informed trading and coordination friction among creditors. We find that short selling bans can enhance welfare by mitigating the negative effects of MSS, particularly in scenarios with high coordination frictions. We also provide policy and empirical implications.

January 2025

Journal of Economic Theory

Executive agencies play a pivotal role in shaping the regulatory environment by crafting rules, enforcing regulations, and overseeing government contracts—all of which can have a profound impact on businesses. For firms, this potential impact creates a clear incentive for firms to influence these agencies, particularly during the critical stages of rulemaking and enforcement. In this context, lobbying emerges as a key tool that companies use to mold the regulatory landscape to their advantage. Unlike politicians, whose decisions are often swayed by electoral cycles and campaign contributions, agency officials are not elected, serve longer terms, and are less susceptible to direct political pressures. As a result, engaging in lobbying efforts with executive agencies is both more complicated and strategically crucial for firms operating within heavily regulated industries. However, the dynamics of such lobbying remain underexplored in the literature.

3 Jan 2025

Research

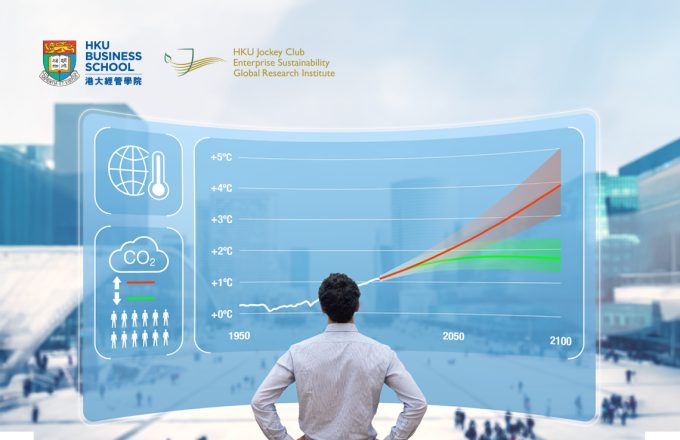

Climate change presents huge challenges for financial markets. How should firm-level exposure to climate change be measured? Does a risk premium for climate change exposure exist? If so, how does it evolve over time? Which underlying climate-related economic variables drive this risk premium? In light of these challenging questions, significant resources have been allocated to develop the area of climate finance to better grasp how the transition to a low-carbon economy affects financial markets. This paper provides additional evidence to understand more fully how climate-related risks and opportunities affect stock returns.

18 Dec 2024

Research

This paper explores green activist investing, whereby environmentally driven activists launch campaigns to promote green shareholder proposals aimed at reducing firms’ environmental impacts. Before 2017, such proposals were rare and seldom supported by large institutional investors. However, since 2020, their number has surged, averaging 55 per year, ranging from 30 in 2020 to 96 in 2023, with a variable success rate averaging 17%. The success of green proposals hinges on proxy votes by pivotal voters, mainly large institutional shareholders, who hold significant stakes across many firms. Together, BlackRock, State Street, and Vanguard alone own the largest shares in 75% of S&P 500 firms and cast 25% of proxy votes. These votes are publicly observable. Hence, this paper models green activism and proxy voting by strategic institutional blockholders who have heterogeneous reputational concerns and varying levels of commitment to green values.

12 Dec 2024

Research

While computer languages may sound alien to economics, I aim to showcase that good programming skills are conducive not limited to economic research, it can also open up endless career possibilities for you in the business world.

31 Jan 2022

Economics

As a teacher, I will push myself to understand the expectations of local employers' and the market dynamics of Hong Kong.

18 Jan 2022

Finance

As a science person, I am impressed by our students' strong business acumen. But as a teacher, other than teaching them how to use quantitative tools to make scientific claims, I also hope that I can encourage them to continue to stay inquisitive about the world and apply their classroom knowledge for the betterment of the society.

5 Jan 2022

Marketing

In April 2025, global financial markets experienced an unprecedented credit crisis, with the yield on the 10-year U.S. Treasury skyrocketing to 4.5%, marking the largest weekly increase since 2001. What are the reasons behind this crisis? Is the tariff policy of the Trump administration a catalyst for market turmoil? Will the U.S. Treasury market successfully navigate through this crisis?

23 Apr 2025

Faculty

When it comes to the trendiest collectible today, it’s not Chanel or Taylor Swift — it’s Labubu, the sharp-eared, wide-eyed character with its signature nine fangs! According to Dr. Tingting Fan, Principal Lecturer in Marketing at HKU Business School, the rise of Labubu under Pop Mart was no coincidence. It was driven by the brand’s unique IP strategy — collaborating with designers worldwide to create diverse character series, supported by an integrated business model covering design, production, and marketing, all tailored to young consumers’ tastes. “Pop Mart has excelled in using data analytics to understand the preferences and trends of consumers aged 18 to 29,” Dr. Fan explained. She added that Labubu’s success went beyond celebrity endorsements — it was about building strong community engagement and brand loyalty. Looking ahead, Pop Mart’s future growth would depend on its ability to stay ahead of market trends and deepen emotional connections with its fans.

16 Apr 2025

Faculty

On “Liberation Day”, US President Donald Trump announced a sweeping plan to impose reciprocal tariffs—taxes that exceeded market expectations and triggered immediate shocks across financial markets. According to Yale’s Budget Lab, these tariffs could raise short-term inflation in the US by 2.3%, reduce household spending by an average of US$3,800, and lower the country’s 2025 GDP growth rate by 0.9%. Dr Y.F. Luk, Honorary Associate Professor at HKU Business School, noted that for the Trump administration, tariffs served both as a policy tool and a political signal. While they could generate government revenue, they were unlikely to replace major taxes. Tariffs might drive limited reindustrialisation, but reviving America’s manufacturing golden age remained uncertain. He also commented that Industrial development takes time, and it’s unclear how long the US economy can withstand sustained high tariffs.

9 Apr 2025

Faculty

With the rapid development of artificial intelligence technology, some borrowers may use it to enhance their credit data in order to obtain loan approvals. Instead of approving borrowers through extensive data collection from multiple sources, lenders might consider self-imposing limits to focus on improving the quality of the data collected while also increasing loan profits.

17 Apr 2025

As millions worldwide are addicted to video games, governments and organizations are actively taking measures to curb this trend. Our research suggests that dynamic pricing can help solve the problem of gaming addiction.

3 Apr 2024

AI image generation is rapidly evolving, driving innovation in marketing, advertising design, and art creation. HKU Business School’s Professor of Innovation and Information Management, Prof. Zhenhui Jack Jiang, along with his research team, recently assessed 22 AI models. They reviewed the performance and potential risks of AI models in image generation.

20 Mar 2025

In April 2025, global financial markets experienced an unprecedented credit crisis, with the yield on the 10-year U.S. Treasury skyrocketing to 4.5%, marking the largest weekly increase since 2001. What are the reasons behind this crisis? Is the tariff policy of the Trump administration a catalyst for market turmoil? Will the U.S. Treasury market successfully navigate through this crisis?

23 Apr 2025

Faculty

But some countries, such as Vietnam, likely had little choice but to prioritize the United States, said Zhiwu Chen, a professor of finance at the University of Hong Kong. He noted how Vietnam had reoriented its economy around attracting American and other foreign brands to manufacture there. “They don’t really have a lot of leeway to take China’s side and offend the U.S.,” he said.

22 Apr 2025

Faculty