Analyzing Hong Kong’s Overall Economic Situation with Data – Part One

In face of a mountain of data, how best to dissect the macroeconomic situation of Hong Kong? With the prevalence of data science today, different data and methods are adopted by individual researchers, together with different reference points for comparison, ultimately leading to a range of divergent conclusions. In order to get a full picture of economic development, it is essential to begin with economic time series, augmented with clear diagrams and tables. By applying relevant theories, we can chart the growth trends and forecast future prospects in various economic sectors. Due to the limited space of this column, I will concentrate on analyzing the historical performance and future challenges of the property market, utilizing graphs based on market data. In the next article, I will delve into the financial sector and tourism industry.

Long-term upward trend of housing prices

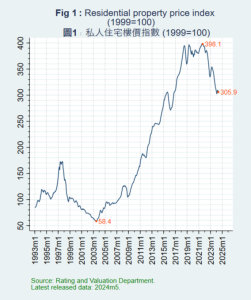

It is widely acknowledged that the local residential property market has undergone rapid growth in the past few decades. Despite periods of fluctuation, both housing demand and property prices have kept increasing in the long term. Figure 1 shows that from its low point in 2004 to its peak in 2021, the overall housing price level surged by six times. One of the driving forces behind the property price hike was economic growth. As an international financial centre and business hub, Hong Kong has attracted a large inflow of foreign enterprises and talent, creating a strong housing demand that has kept pushing property prices up.

Figure 1 Residential property price index

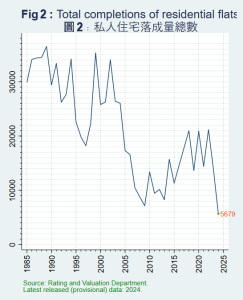

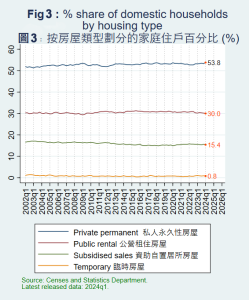

Another rationale behind the price rise is limited land supply. With a population exceeding 7.5 million and still on the increase, Hong Kong is plagued by not only space shortage for new housing developments but also a decline in the number of housing units completed (see Figure 2). Local housing prices have been soaring due to undersupply of housing units and intense competition among buyers. For decades, the homeownership rate has remained at around 50% (see Figure 3).

Figure 2 Total completions of residential flats

Figure 3 Share of domestic households by housing type (%)

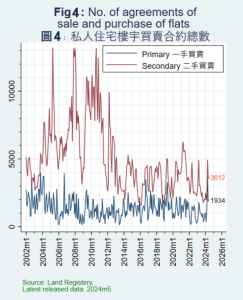

During the 2010s, to stem the housing price hike driven by a red-hot market, the SAR Government introduced several rounds of so-called “spicy measures” and regulatory responses aimed at curbing housing demand. Subsequently, residential transactions shrank significantly (see Figure 4). However, all these “harsh measures” were scrapped in 2024.

Figure 4 Number of sale and purchase agreements of flats

Market fluctuations could result from such factors as interest rate movements, market sentiment, government policy, etc. In the long run, economic growth and land undersupply are bound to drive up housing prices in Hong Kong. Given that housing market development is still a major economic growth engine, the SAR Government must ensure that steep property prices do not put homeownership beyond the reach of the general public while also minimizing the risk of a long-term economic recession similar to the one triggered by the housing market crash in 1997.

Non-residential market under near-term pressure

As for the non-residential property market, Hong Kong being an international financial centre offers a string of advantages, ranging from a low tax-rate regime, a sound legal system, to a transparent regulatory framework. These have been a magnet for attracting Mainland corporations, multinational companies, and financial institutions to expand their businesses in the SAR, thus lifting the demand for office space.

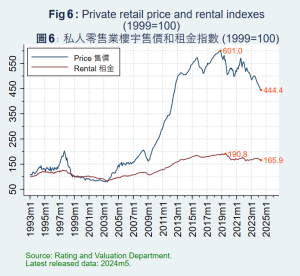

In terms of retail premises, retailers from around the world are drawn to set up shop in Hong Kong by its strategic location as a gateway to the Mainland and Southeast Asian markets. Inbound visitors (especially those from the Mainland) are instrumental in stimulating demand for retail outlets, particularly in shopping hot spots such as Causeway Bay and Tsim Sha Tsui. In addition, the high income of Hongkongers is also conducive to the development of retail premises for high-end and luxury brands.

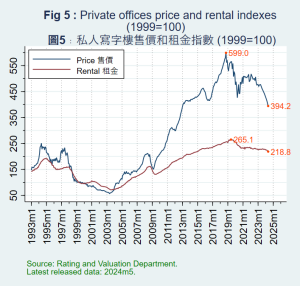

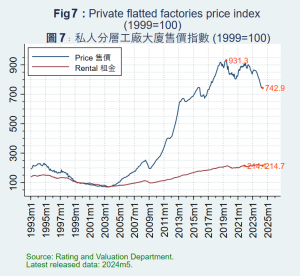

Owing to limited land supply and high property costs, private flatted factories that accommodate light industrial activities, including manufacturing and warehousing, provide affordable and convenient premises for small and medium enterprises (SMEs), creative and cultural industries, innovation and science enterprises, etc. All these factors contribute to the demand and long-term price rise in the non-residential market (see Figures 5–7).

Figure 5 Private offices price and rental indexes

Figure 6 Private retail price and rental indexes

Figure 7 Private flatted factories price and rental indexes

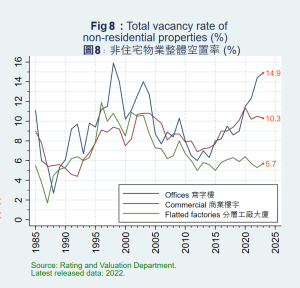

With the continued surge in non-residential property prices, companies (particularly SMEs) will find the property rent more unaffordable than ever. Moreover, deteriorating business environment due to geopolitics, changing consumption pattern among Mainland visitors, and intense competition from the Guangdong-Hong Kong-Macao Greater Bay Area have put pressure on non-residential property prices in recent years. Amid this backdrop, Hong Kong has experienced increased vacancy rates in both offices and retail outlets (see Figure 8).

Figure 8 Total vacancy rate of non-residential properties (%)

Dr. Chi Pui Ho

Lecturer in Economics

(This article was also published on July 17, 2024 in the “Lung Fu Shan” column of the Hong Kong Economic Journal)