Analyzing Hong Kong’s Overall Economic Situation with Data – Part Two

Over the past few decades, thanks to its prime geographical location, open access to international trade and investment, robust banking sector, sound regulatory framework, and vibrant stock market, Hong Kong has facilitated the demand for local financial services from investors and foreign companies. The city has thus successfully evolved into an international financial centre.

Pressing need for financial adjustments amid geopolitical challenges

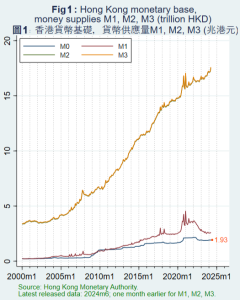

Under the influence of the Linked Exchange Rate System, Hong Kong’s money supply and interest rate movements mostly mirror the US Federal Reserve’s monetary policy decisions (see Figure 1).

Figure 1 Hong Kong monetary base and money supplies M1, M2, M3 (HK$ in trillions)

In other words, to maintain the stability of Hong Kong’s exchange rates, the SAR Government has relinquished its monetary policy autonomy. This in turn compromises its ability to address economic fluctuations and the potential risk of asset price inflation. In addition, the exchange rate of the Hong Kong dollar to other currencies will also fluctuate with the US dollar (see Figure 2), thus influencing the SAR’s import and export performance.

Figure 2 Trade-weighted exchange rate and HK-RMB exchange rate

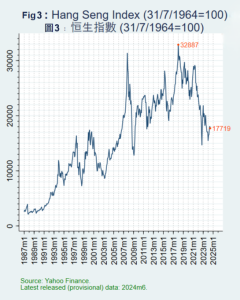

At the turn of the 21st century, against the backdrop of globalization and its integration with the Mainland stock markets, Hong Kong continued to lure investors with the help of its status as the main gateway to China for foreign investments. This is evidenced by the rising trends of the SAR’s Hang Seng Index, stock trading volume, and market capitalization (see Figure 3).

Figure 3 Hang Seng Index

Furthermore, Hong Kong’s role as China’s window for international liquidity has also contributed to the growth in loans and advances. Hong Kong is well-equipped to provide intermediary services for Mainland enterprises seeking international financing as well as for foreign companies looking to invest in the Mainland. This has been conducive to the establishment of local lending platforms and expansion of cross-border financing activities. The sophisticated legal system and ideal regulatory environment have boosted the confidence of lenders, thus fostering an increase in loans and advances. These financial services have in turn supported the development of Hong Kong’s trade, real estate, and manufacturing industries.

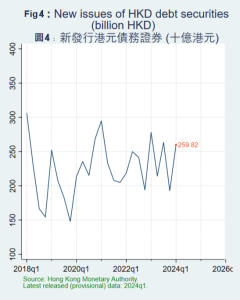

Hong Kong boasts the status as an international financial centre, a strategic location as the bridge to Mainland China, and the constructive role of the Hong Kong Monetary Authority and the HKEX as a twin engine of the debt securities market. Hence, securities issuers and investors including multinational corporations and financial institutions have been flocking to the city in search of funding for business expansion, acquisitions, refinancing, etc. This has enabled Hong Kong to become a major debt issuance centre for the Southeast Asia region (see Figure 4).

Figure 4 New issuances of HKD debt securities (HK$ in billions)

It is noteworthy that recent years have seen China-US geopolitics pose a potential impact on Hong Kong’s standing as an international financial centre. The local financial market has undergone consolidation in recent years, as evidenced by the relatively steep fall of the total market value and total funds raised in the stock market. The extent of adjustment by the financial sector and the future development of Fintech and asset management will determine whether Hong Kong can reinforce and maintain its status as a leading international financial centre in Asia.

Social media-induced change in tourist spending patterns

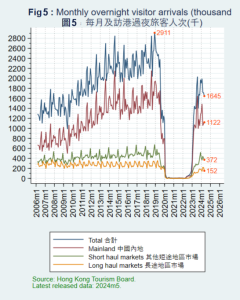

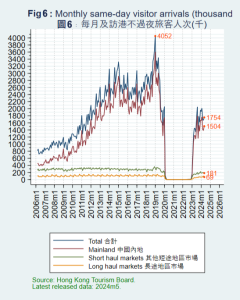

With its historical development as a city where East meets West, its accessible transport infrastructure, and its reputation as a shopping paradise and international convention and exhibition centre, Hong Kong has been a preferred destination for leisure and business travellers from all over the world for decades, fuelling the growth of the local tourism industry. These factors are reflected in the long-term upward trend in inbound visitors, who are primarily from the Mainland (see Figures 5–6).

Figure 5 Monthly overnight visitor arrivals (in thousands)

Figure 6 Monthly same-day visitor arrivals (in thousands)

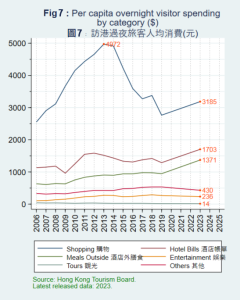

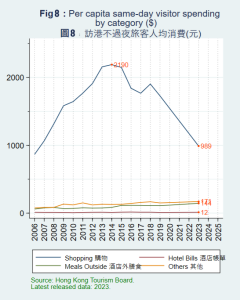

Since the 2010s, however, the emergence of social media has made it more convenient for visitors to obtain travel information about Hong Kong and to share their experiences. Fierce competition from neighbouring regions has also effected a gradual change to the travel and consumption patterns of inbound visitors.

From the mid-2010s onwards, per-capita spending of visitors to Hong Kong began to show an adverse trend mainly due to a continued decline in per-capita shopping expenditure (see Figures 7–8).

Figure 7 Per-capita overnight visitor spending (HK$)

Figure 8 Per-capita same-day visitor spending (HK$)

In the aftermath of the social incident in 2019 and the COVID-19 pandemic in 2020, which dealt a serious blow to the local tourism industry, Hong Kong has yet to see a return to the peak levels of visitor arrivals and per-capita spending recorded during the 2010s.

It is foreseeable that Hong Kong’s tourism industry is bound to face challenges, ranging from its image and positioning, the attractiveness of tourist facilities and services to global travellers, to industry policy and management structure, and the international political environment. For the industry to get back on track, a concerted effort between the government and the general public is indispensable.

Dr. Chi Pui Ho

Lecturer in Economics

(This article was also published on July 18, 2024 in the “Lung Fu Shan” column of the Hong Kong Economic Journal)