Combat Misinformation for a Stable Economy

Dr Maurice Tse and Mr Clive Ho

28 August 2024

In this day and age, when social media is all the rage and artificial intelligence (AI) along with digital transformation are advancing in leaps and bounds, the rampant production and dissemination of information can influence personal behaviour and investment decisions. The phenomenon may also potentially incite panic in society and the market, giving rise to a credibility crisis. In January 2024, the World Economic Forum declared misinformation and disinformation as the greatest short-term risks worldwide.

How can inaccurate information and deceiving information be so alarmingly destructive? The answer lies in the fact that, when deployed with conspiracy theories, such information can come across as fully credible, leaving the general public completely at its mercy. With the world being constantly flooded with information that is hard to verify, political polarization becoming increasingly prevalent, and the global economic downturn showing no sign of abating, rumours and conjectures abound. These range from conspiracy theories about currency wars to allegations that the US moon landing was faked.

The steep price of hocus-pocus

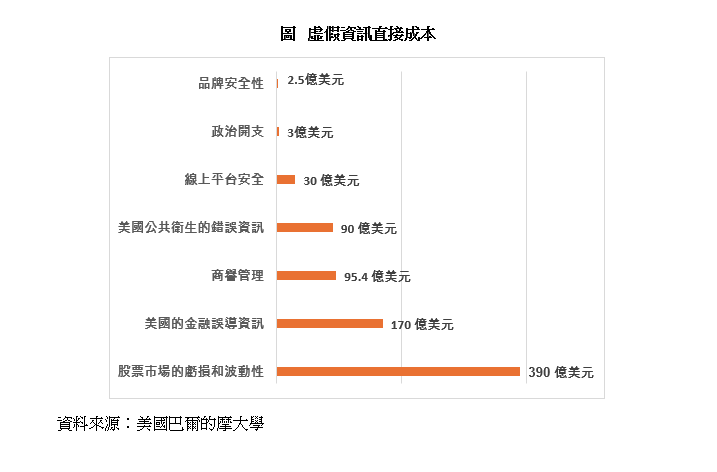

Time is of utmost importance in financial investment. Even within the infinitesimal span of a few milliseconds, a single news update or social media post can trigger price fluctuations in the market. In 2019, Roberto Cavazos, a professor at the University of Baltimore’s School of Business in the US, and the cybersecurity company CHEQ jointly published a research report (see 【Note 1】). The publication drew attention to the fact that every year, stock market losses resulting from fake news amount to US$39 billion. Investors’ decisions influenced by misinformation sustain losses of around US$17 billion on an annual basis (see Figure).

For companies targeted by disinformation attacks, their annual expenditure on reputation management reaches approximately US$9.54 billion. Their annual expenditure on addressing false information in the healthcare sector is around US$9 billion, with the greatest costs incurred in measures to combat fake news about the anti-vaccine campaign and climate change. Global losses induced by disinformation amount to a total of US$78.2 billion.

Financial losses for many in pump and dump schemes

It is widely known that political election campaigns are not immune to disinformation. Research shows that approximately US$300 million is spent annually on phoney political ads. During the 2020 US presidential election, at least US$200 million was spent on fake news. As also indicated by researchers, their estimates only illustrate the basic direct costs. The real underlying costs far exceed the estimated figures.

Of the journalists surveyed in a report released by the US Pew Research Centre in 2022, 26% of the respondents indicate that they have unknowingly reported news containing disinformation. In their opinion, identifying disinformation is more and more challenging, especially as the advancement of AI technology facilitates the spread of false information. According to a 2023 survey conducted by the insurance company Nationwide, 34% of American non-retiree investors aged between 18 and 54 have been influenced to make investments based on misleading financial information (e.g. pump and dump schemes) found on the internet or social media. Not only have investors suffered losses but the market’s credibility has also been undermined as a result.

As mentioned in the research study by Arcuri et al. published in the Journal of Economics and Business in 2023 (see 【Note 2】), some investors might be unable to agree on the true value of a company due to their failure to distinguish between real and fake news. Consequently, the target company’s stock price dances to the tune of disinformation. The study analyses fake news originating from overseas but released in America and Europe from 2007 to 2019. In terms of stock returns, the findings demonstrate that unfavourable fake news generates substantial short-term negative impacts while favourable or neutral news has minimal impacts.

Conspiracy theories bleeding into economics

What is even worse, under the echo-chamber effect of social media, all sorts of unverifiable conspiracy theories have gained wide currency and approval. One notable example is the allegation that the government of an economic power has been tampering with its GDP, inflation, and employment figures to window-dress the domestic economy. As a matter of fact, this absurd way of thinking does not hold water because such large-scale economic data require rigorous statistical methods, involving input from countless independent statisticians and scholars.

All statistical reports must be meticulously reviewed by economists and analysts from around the world, making it virtually impossible to conceal any major frauds. Should investors fall for such conspiracy theories and make irrational decisions, e.g. hoarding commodities or abandoning the stock market altogether, the long-term growth of their investment portfolios could be compromised.

Furthermore, there are also conspiracy theorists who claim that the central bank of another economic power is harbouring a secret agenda to benefit a few at the expense of the majority by manipulating interest rates and the monetary policy. This rumour is nothing but ridiculous. Under strict supervision, the central bank’s operations are extremely transparent, with all its comprehensive reports and meeting minutes made public. Allegations of the so-called secret agenda are not only utterly groundless but simply do not square with the accountability mechanisms in place. If investors are misled into bypassing traditional investment channels or making rash decisions, national financial stability and growth could be jeopardized.

Despite the fact that allegations of insider trading and stock market manipulation are also common, security trading regulators in leading markets are generally dedicated to combating these irregularities. Given the immense scope and complexity of the stock market, it is extremely unlikely that a small number of individuals could control it systematically. While factors influencing market dynamics are many, including economic data, business performance, and geopolitical risks, investors misled by disinformation could lose their faith in the market or even withdraw from investment activities. They may, therefore, miss wealth-creation opportunities in the stock market, particularly those for long-term asset gains.

There is yet another group of conspiracy theorists known as the “gold bugs”. They claim that with the imminent collapse of the traditional fiat currencies (for instance, the US dollar) and the emergence of economic recession or hyperinflation, gold is the only safe-haven asset.

They also believe that central banks and national governments attempt to suppress gold prices through manipulation in order to prevent the general public from abandoning traditional currencies. Although gold is indeed an asset with intrinsic value, it is by no means immune to market fluctuations, nor is it likely to offer the kind of stable returns produced by diversified investments.

This group of conspiracy theorists obviously overlook the reality that gold prices are shaped by a basket of factors, ranging from supply and demand to investor sentiments and the macroeconomic environment. The view that governments suppress gold prices is not only baseless but also dismissive of the transparency of the gold market and the extent to which the market is regulated. Investors misled by this conspiracy theory may become exceedingly reliant on gold. Failing to diversify their investments will only increase their investment risks and limit their potential returns.

Setting the record straight to safeguard against losses

So long as social media or other platforms keep being the fertile ground for churning out distorted information and the general public continue to have knee-jerk reactions to news, the global economy will remain susceptible to constant risks of deception. By taking advantage of potential panic, conspiracy theorists undermine ordinary people’s logical reasoning and analytical abilities, leaving them as sitting ducks for brainwashing and outrageous rumours. Hence, whenever we come across sensational articles attempting to manipulate readers’ emotions with expressions such as “hot off the press”, “breaking news”, “going viral”, or other similar clickbait headlines, we should be ultra-alert and beware of malicious disinformation.

As the saying goes, “Lies repeated a thousand times will become truth.” That is why critical thinking starts with us. Before forwarding a message, we should ensure the source is reliable, the content is reasonable or objective, and the views are based on facts or science. These basic criteria can help us to sort out signal from noise. Not only can investors benefit from this, but the impact of heavy losses incurred by disinformation on the world’s economy can also be mitigated.

【Note 1】: Cavazos, R., and CHEQ. 2019. “The Economic Cost of Bad Actors on the Internet: Fake News in 2019”.

【Note 2】: Arcuri, M.C., Gandolfi, G., and Russo, T. May-June 2023. “Does fake news impact stock returns? Evidence from US and EU stock markets”. Journal of Economics and Business vol.125-126.