Will the AI Market Experience a Repeat of the 2000 Dotcom Bubble?

The artificial intelligence (AI) arms race, triggered by the rise of ChatGPT two years ago, has been escalating. State-of-the-art technology is poised to force irrevocable change across industries. In the midst of national governments and businesses investing heavily in AI, Japan’s SoftBank Group announced its plan to invest US$500 million in OpenAI at the end of last month.

In the research report published in July 2024, Jim Covello, head of stock research at Goldman Sachs, argues that an AI investment bubble is forming. While the bubble is unlikely to burst any time soon, the performance of all related products launched so far has been less than desirable. For example, there have been insufficient cost-saving measures for AI coding and customer services, and there are times when AI search capabilities of AI are not ideal. Despite the staggering amounts spent by large tech companies, the apparent yields produced by these new products are poor. Although generative AI can perform computer programming, its constant mistakes require users to step in with corrections from time to time. Its capability to solve complex problems is therefore questionable.

Tracing the origin of market bubbles

When speculators inflate the valuations of tech companies, a tech bubble may emerge, triggering drastic adjustments in the market. This could cause investors to suffer massive losses and even exert a widespread influence on the economy. It is advisable for investors, policymakers, and industry stakeholders to understand the psychological, economic, and structural factors leading to a market bubble.

Looking back at the collapse of the hi-tech bubble in the late 1990s, even though the business models of many dot-com companies were untested, capital kept flooding in. While AI was not yet the apple of investors’ eyes, there was already similar speculation among companies developing AI technology at the time. The bursting of the dot-com bubble drove these companies out of business one by one, and the NASDAQ Composite Index crashed after peaking, resulting in colossal bankruptcies and losses.

The resurgence of AI technology between 2015 and 2018 ushered in a new wave of investments, with start-ups attracting investments worth billions of US dollars. Companies incorporating AI into their business models―often overvalued―lacked clear profit-making strategies even if they managed to create some technologically revolutionary impact. Add to that the emergence of cryptocurrencies and blockchain technology, 2017 witnessed the short-lived ascent and collapse of cryptocurrencies, marking a clear case of the high volatility and risks associated with digital assets. The COVID-19 pandemic accelerated the adoption of technology, leading to the overvaluation of software-as-a-service businesses as well as radical market adjustments.

Suppose generative AI could subvert all industries in the next five to 10 years. However, if its development remains static, these tech companies, despite their ability to secure enormous funds, will not contribute to boosting corporate productivity and profits. An asset bubble formed over time is bound to burst eventually. While leading AI companies such as Meta, Google, and Microsoft have clear paths to profitability, AI start-ups in private markets may be valued at near-bubble levels. This naturally poses a key question in Wall Street: When will these companies be able to generate profits from AI? Ultimately, investors’ concerns boil down to this: is all this really worth it?

Rational market assessment

As pointed out by Covello in the research report, most technology transformations in history, revolutionary ones in particular, have involved the replacement of high-cost solutions with low-cost solutions. Expected to total US$1 trillion in the next several years, the investment in AI infrastructure build-out is not cost-effective at all as existing technologies will be replaced at exorbitant costs. In view of the investments in AI amounting to hundreds of billions of US dollars, if such input fails to improve productivity and profitability, all stocks that have skyrocketed due to pumped-up forecasts for AI will inevitably take a dire plunge.

While generative AI is still in its infancy, its adoption by companies is also at an embryonic stage. Core suppliers such as Taiwan Semiconductor Manufacturing Company may see potential for stupendous profits, but they need to maintain sustainable development in all aspects of the value chain to realize relevant revenue and impact for enterprises.

An article in the July issue of The Economist cites US statistical data as evidence of investors’ worries about an AI bubble. While the use of chatbots, for example ChatGPT, has become quite common, the rate of AI adoption by enterprises is very low. According to the survey results reported in the article, fewer than 5% of the company respondents have used AI in the past couple of weeks while below 7% intend to use AI in the following six months. This goes to show that the utilization of AI in the business sector is minimal. A study by the Adecco Group finds that among 2,000-plus senior executives from nine countries across four continents, up to 57% lack confidence in their company management’s AI skills and knowledge.

As for companies benefiting from AI, e.g. Walmart, they see no significant rise in their stock prices. Companies that really benefit from the technology are probably those on the core supply side, e.g. Nvidia, rather than those on the demand side. Despite burgeoning AI development in recent years, no nation has experienced significant growth in productivity, including developed countries such as the US.

Clarifying investment psychology

As a matter of fact, investors’ psychology can also lead to a market bubble. For instance, the Fear of Missing Out (FOMO) can cause irrational buying behaviour and push up stock prices. Carpet-bomb media coverage is conducive to fuelling the hype around emerging technologies. Low interest rates and a capital-flush environment will stimulate risk investment, causing technology stock prices to surge. While technological breakthroughs can attract capital, profit-making takes time. Numerous psychological factors can distort the decision-making process, paving the way for tech bubbles. When dealing with market fluctuations, understanding these adverse factors can give investors a better idea of their own biases, enabling them to make rational investments.

Apart from making poor judgments because of FOMO, investors may also overestimate self-ability to predict market trends, making them more prone to taking risks and thereby contributing to the gradual development of bubbles. In addition, bias can convince them to keep investing in the belief that prices will continue to rise, oblivious even to objective warning signals. Blinded by their faith in never-ending high growth based on past prices and trends, they are unable to recognize when a speculative bubble is forming.

As predicted by Meta, “We don’t expect our gen AI products to be a meaningful driver of revenue in 2024. But we do expect that they’re going to open up new revenue opportunities over time that will enable us to generate a solid return off of our investment.” However, long accustomed to the practice of quarterly sales and profits, many investors may underestimate the long-term impact of generative AI while overestimating its short-term potential. Gil Luria, analyst at D.A. Davidson, said, “If you are going to invest now and get returns in 10 to 15 years, that’s a venture investment. That’s not a public company investment. For public companies, we expect to get return on investment in much shorter time frames. So that’s causing discomfort, because we’re not seeing the types of applications and revenue from applications that we would need to justify anywhere near these investments right now.”

Getting a grasp on market trends

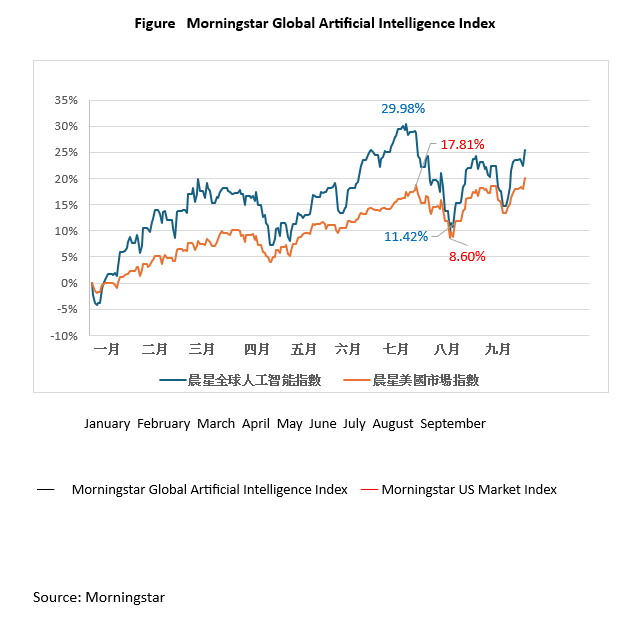

After leading the market on an upward trend in the second quarter of this year, the largest AI company dragged the market down in the third quarter. As a result, many investors have shifted from large-cap tech stocks to value stocks. The Figure shows that the Morningstar Global Artificial Intelligence Index plunged from a market high on 16 July 2024 to a new market low on 5 August 2024, representing a fall of 18.56%, which is double that of the Morningstar US Market Index at 9.21%. Despite having recovered some of the lost ground, AI stocks have been bringing market returns down in the past couple of months. Since 16 July, the 12 stocks in the Morningstar US Market Index that have driven down market returns are all tech stocks closely related to AI.

Past experience with the formation and bursting of tech bubbles demonstrates the cyclical nature of technology investment. While the initial overinvestment could lead to overvaluation, after the market has adapted to reality, major stock price adjustments will follow. In light of the continuous development of AI and its integration into various industries, understanding the law of market cycles is clearly a top priority for investors and policymakers.

References

Will A.I. Be a Bust? A Wall Street Skeptic Rings the Alarm. Jim Covello

“What happened to the artificial-intelligence revolution? So far the technology has had almost no economic impact”, The Economist, 2 July 2024

https://discover.adeccogroup.com/Business-Leaders-2024_Global-Report

Mr Clive Ho