People’s schedules are jointly determined by their biological clock and social clock. However, their social clock often deviates from the biological clock (e.g., having to get up earlier than one’s natural wake-up time for work or study, having to stay up to work night shifts or meet a project deadline)—a phenomenon known as “social jetlag.” How does social jetlag impact consumer behavior? Using field data and experiments, we show that social jetlag decreases conspicuous consumption because consumers experiencing social jetlag are less interested in social interaction. This effect is weakened when social interaction occurs among familiar others rather than strangers, when conspicuous consumption does not draw social attention, and when consumers expect to use a luxury product in a private setting.

Dec 2022

Journal of Consumer Research

This paper uses individual-level data linking stock investments with work performance to examine how changes in stock market wealth affect worker output. We document that a 10% increase in monthly income from stock market investments is associated with a decrease of 3.8% in the same investor’s next-month work output. The negative output response is not driven by concurrent economic conditions and is unexplained by investor-specific liquidity needs. Consistent with the reference dependence interpretation, the response is short-lived and the effect is stronger when the total income has reached a reference income. Overall, our results highlight a novel channel of transmitting stock market fluctuation through labor supply.

Nov 2022

Journal of Financial Economics

New technologies and innovative business models are leading to connected, shared, autonomous, and electric solutions for the tomorrow of urban transport and logistics (UTL). The efficiency and sustainability of these solutions are greatly empowered by the capability of understanding and utilizing the tremendous amount of data generated by passengers, drivers, and vehicles. In this study, we first review the innovative applications in UTL and several related research areas in the operations management (OM)/operations research (OR) literature. We then highlight the sources, types, and uses of data in different applications. We further elaborate on business analytics techniques and software developed to facilitate the planning and management of UTL systems. Finally, we conclude the paper by reflecting on the emerging trends and potential research directions in data-driven decision making for smart UTL.

Oct 2022

Production and Operations Management

Problem definition: Observing the retail industry inevitably evolving into omnichannel, we study an offline-channel planning problem that helps an omnichannel retailer make store location and location-dependent assortment decisions in its offline channel to maximize profit across both online and offline channels, given that customers’ purchase decisions depend on not only their preferences across products but also, their valuation discrepancies across channels, as well as the hassle costs incurred. Academic/practical relevance: The proposed model and the solution approach extend the literature on retail-channel management, omnichannel assortment planning, and the broader field of smart retailing/cities. Methodology: We derive parameterized models to capture customers’ channel choice and product choice behaviors and customize a corresponding parameter estimation approach employing the expectation-maximization method. To solve the proposed optimization model, we develop a tractable mixed integer second-order conic programming reformulation and explore the structural properties of the reformulation to derive strengthening cuts in closed form. Results: We numerically validate the efficacy of the proposed solution approach and demonstrate the parameter estimation approach. We further draw managerial insights from the numerical studies using real data sets. Managerial implications: We verify that omnichannel retailers should provide location-dependent offline assortments. In addition, our benchmark studies reveal the necessity and significance of jointly determining offline store locations and assortments, as well as of incorporating the online channel while making offline-channel planning decisions.

Sep-Oct 2022

Manufacturing & Service Operations Management

Problem definition: We study an urban bike lane planning problem based on the fine-grained bike trajectory data, which are made available by smart city infrastructure, such as bike-sharing systems. The key decision is where to build bike lanes in the existing road network. Academic/practical relevance: As bike-sharing systems become widespread in the metropolitan areas over the world, bike lanes are being planned and constructed by many municipal governments to promote cycling and protect cyclists. Traditional bike lane planning approaches often rely on surveys and heuristics. We develop a general and novel optimization framework to guide the bike lane planning from bike trajectories. Methodology: We formalize the bike lane planning problem in view of the cyclists’ utility functions and derive an integer optimization model to maximize the utility. To capture cyclists’ route choices, we develop a bilevel program based on the Multinomial Logit model. Results: We derive structural properties about the base model and prove that the Lagrangian dual of the bike lane planning model is polynomial-time solvable. Furthermore, we reformulate the route-choice-based planning model as a mixed-integer linear program using a linear approximation scheme. We develop tractable formulations and efficient algorithms to solve the large-scale optimization problem. Managerial implications: Via a real-world case study with a city government, we demonstrate the efficiency of the proposed algorithms and quantify the trade-off between the coverage of bike trips and continuity of bike lanes. We show how the network topology evolves according to the utility functions and highlight the importance of understanding cyclists’ route choices. The proposed framework drives the data-driven urban-planning scheme in smart city operations management.

Sep-Oct 2022

Manufacturing & Service Operations Management

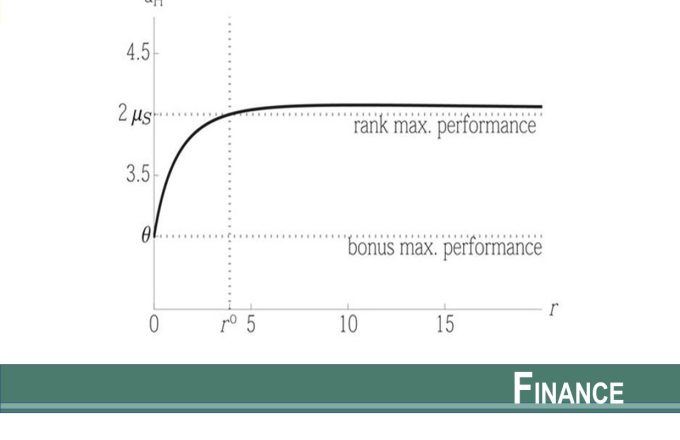

The rewards received by financial managers depend on both relative performance (e.g., fund inflows based on fund rankings, promotions based on peer comparisons) and absolute performance (e.g., bonus payments for meeting accounting targets, hedge-fund incentive fees). Both relative and absolute performance rewards engender risk-taking. In this paper, we show that these two sources of risk-taking, relative and absolute performance rewards, mitigate the risk-taking incentives produced by the other. This mutual incentive-reduction effect generates a number of novel predictions about the relationship of managerial risk-taking with the structure of relative and absolute performance rewards.

Oct 2022

The Journal of Finance

Although financial fraud detection research has made impressive progress because of advanced machine learning algorithms, constructing features (or attributes) that can effectively signal fraudulent behaviors remains a challenge. In recent years, a new type of fraud has emerged on peer-to-peer (P2P) lending platforms, where individuals can borrow money from others without a financial intermediary. In these markets, the information asymmetry problem is seriously elevated. Inspired by the fraud triangle theory and its extensions, and using the design science research methodology, we construct five categories of behavioral features directly from P2P lending transaction data, in addition to the baseline features regarding borrowers and loan requests. These behavioral features are intended to capture the fraud capability, integrity, and opportunity of fraudsters based on their loan requests and payment histories, connected peers, bidding process characteristics, and activity sequences. Using datasets from real users on two large P2P lending platforms in China, our evaluation results show that combining these additional features with the baseline features significantly enhances detection performance. This design science research contributes novel knowledge to the financial fraud detection literature and practice.

Sep 2022

MIS Quarterly

We develop a dynamic model to analyze the impact of input tariff liberalization on input prices, trading decisions, and productivity. Although input tariffs directly affect input price benefits of importing, their impact on trade participation generates indirect benefits through productivity improvements and complementarity between importing and exporting. To disentangle these effects, we separately measure importing's effect on input prices and productivity and examine Chinese paint manufacturers' reaction to input tariff liberalization. We find that a mild short-term effect of tariff liberalization is amplified in the long run by induced trade participation, resulting in even higher productivity and lower input prices.

Autumn (Fall) 2022

The Rand Journal of Economics

We propose a model of collateralized lending in which (1) borrowers endogenously determine collateral quality and (2) lenders can produce costly information about collateral payoffs. Our model yields several novel predictions: wealthier economies use lower quality collateral in equilibrium, have more severe financial crises, and have less frequent crises. We provide both micro and macro empirical evidence. In the U.S. mortgage market wealthier lenders accept lower quality collateral, and, looking across countries, wealthier economies use lower quality collateral and the collateral channel explains the link between wealth and crisis severity.

Sep 2022

Journal of Economic Theory