Pricing Climate Change Exposure

- The paper investigates whether and how financial markets price climate change exposure, specifically, whether a risk premium is associated with companies more exposed to climate change opportunities, regulations, and physical impacts.

- The authors introduce a novel measure of firm-level climate change exposure by analyzing how frequently climate-related terms are mentioned in earnings conference call transcripts. This measure captures investor attention to both risks and opportunities associated with climate change.

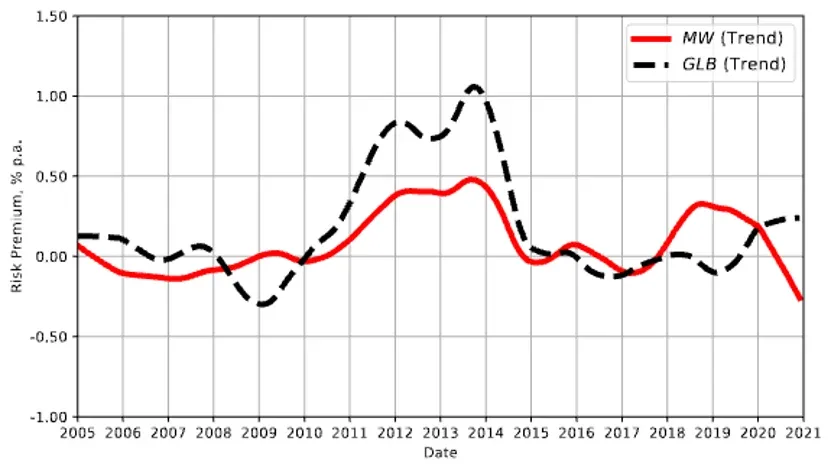

- Forward-looking expected-return proxies deliver an unconditionally positive risk premium, with maximum values of 0.5% to 1% per annum between 2011 and 2014.

- The risk premium has been lower since 2015, given the expected return proxy explicitly accounts for the higher opportunities and the lower crash risks that have characterized high-exposure stocks. This finding suggests the priced part of the risk premium primarily originates from uncertainty about climate-related upside opportunities, because the risk premium fell as those uncertainties were reduced.

- In the time series spanning 2005-2020, the risk premium is negatively associated with levels of green innovation, Big Three (Vanguard, Blackrock, and State Street) holdings, and ESG fund flows, and positively associated with climate change adaptation programs.

Source Publication:

Zacharias Sautner, Laurence van Lent, Grigory Vilkov, Ruishen Zhang (2023) Pricing Climate Change Exposure. Management Science 69(12):7540-7561.

Climate change presents huge challenges for financial markets. How should firm-level exposure to climate change be measured? Does a risk premium for climate change exposure exist? If so, how does it evolve over time? Which underlying climate-related economic variables drive this risk premium? In light of these challenging questions, significant resources have been allocated to develop the area of climate finance to better grasp how the transition to a low-carbon economy affects financial markets. This paper provides additional evidence to understand more fully how climate-related risks and opportunities affect stock returns.

The authors use a novel measure of firm-level climate change exposure based on how frequently climate-related terms (“bigrams”) are mentioned in earnings conference call transcripts. Climate change exposure (hereafter, CCE) captures investor attention to both risks and opportunities associated with climate change. The authors further decompose this measure into:

- Exposure to opportunities related to climate change, such as renewable energies, carbon capture, etc.

- Exposure to regulatory shocks related to climate change, such as carbon tax.

- Exposure to physical shocks related to climate change.

A concern with realized return as a proxy for expected return is that it may not work well in producing reasonable risk premiums, due to our short sample period and the infrequently observed exposure measures. To address this estimation challenge, this paper utilizes both realized returns and forward-looking proxies for expected returns, namely, the Martin-Wagner (MW) and the generalized lower bound (GLB) measures. These measures exploit option-implied information and differ in the assumed investor preferences used to derive the risk premium estimates. MW assumes variance is the sufficient risk statistic for investors, whereas GLB assume investors also consider extreme risks and opportunities. Hence, both approaches use different, though overlapping, information from the options market to estimate expected returns.

Figure 1. Equilibrium strategies and green sentiment

Note: Figure 1 shows the trend component of the time series of the risk premium for CCE (in % per annum), estimated from the expected excess return proxies of MW and GLB. Risk premiums are obtained jointly with the 6-factor model (4- and 5-factor models combined) premiums and stock characteristics. Trend captures the trend of the risk premium based on a decomposition of the raw estimate into additive seasonal, trend, and residual components using the STL decomposition (Cleveland et al. 1990) over a 12-month period. The sample covers the period from 01/2005 to 12/2020 and includes S&P 500 stocks.

The patterns for the two proxies for expected returns look different than the realized premium and differ subtly from each other.

For both expected return proxies, the risk premium of climate change exposure fluctuated around zero before 2011. From 2011 onward, both premiums turned positive, with the MW-based premium gradually rising to about 0.5% per annum in 2012 and the GLB-based premium experiencing an even faster increase to about 1% per annum between 2012 and 2014. Since 2015, both premiums have reverted to almost zero, but the MW proxy has stayed at a slightly higher level.

The dynamics of the expected return proxies can be attributed to how investors map climate change exposure into variance and higher-order risks. Between 2011 and 2014, investors perceived high-exposure stocks as highly volatile and as having an elevated crash risk. By contrast, beginning in 2015, they started to associate smaller variance and relatively higher opportunities with such stocks. Whereas the lower variance of high-exposure stocks decreases the risk premium for both proxies, the reallocation of the likelihood of right- versus left-tail events further reduces the premium among investors with preferences for higher-order risks.

Several climate-related economic channels explain the effects of the risk quantities. First, green innovation in the economy decreases the risk premiums. Second, the compensation for high-exposure stocks increases in the proportion of climate change exposure by firms from U.S. states that adopt climate change adaptation plans. Third, flows into ESG funds decrease the risk premium (this effect is not robust to all controls). Fourth, the oil price is positively related to the risk premium. Fifth, higher aggregate holdings of Big Three (Vanguard, Blackrock, and State Street) funds, weighted by climate change exposure, significantly decrease the risk premium.