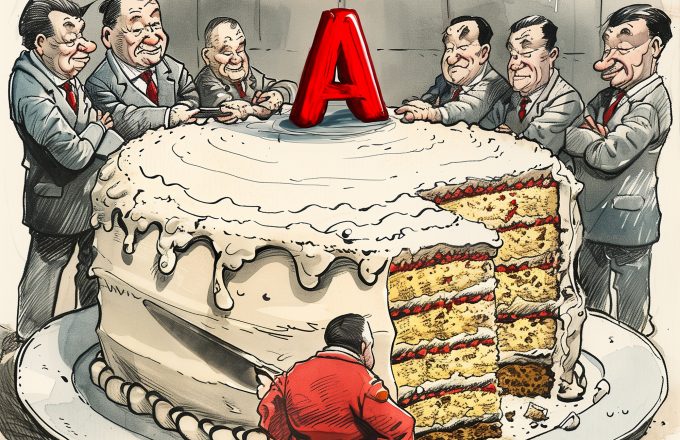

WSJ talked about the current trend of corporate dictatorships, where companies are run by founder-chief executives who hold on to special voting shares or run boards as their own personal fief. The article highlights a study by Prof. Roni Michaely of the University of Hong Kong, Hyunseob Kim of the Chicago Federal Reserve, and Doron Levit of University of Washington, which found that the benefits of a benign corporate dictatorship wane over time. The research, which examined 920 companies with both voting and non-voting shares, revealed an intriguing pattern. During the initial years following an IPO, companies with founder control tended to perform on par with their more democratically governed counterparts. However, after a decade or so, a significant premium emerged for shares with full voting rights. The article argues that granting full voting rights to all stakeholders is still the best form of governance for companies in the long run.

19 Jul 2024

教学人员