Case studies provide a fertile basis for the application of theoretical concepts to real-world situations. The Asia Case Research Centre (ACRC) at HKU Business School leverages the strength of HKU’s research capabilities to offer a repository of context-rich, Asia-focused and research-backed case studies. Demand for cases in the Asian context is high and ever-increasing. By filling this gap, the ACRC strengthens the curricula and enables world-class learning and teaching in business education.

Founded in 1997, the ACRC is one of the world’s leading case centres and the pioneer in Asian case development. To bridge academic knowledge and real-world business challenges, the ACRC builds and leverages relations with leading companies in the region, ranging from traditional industries to “new economy” companies. Published cases are distributed globally, most notably through a 20+ year partnership with Harvard Business School Publishing.

ACRC cases are widely used by universities, companies and organizations from 170 countries and regions around the world. The world’s leading universities all use ACRC cases in the classroom. Its cases also form the foundation of the annual HSBC/HKU Case Competition, the largest business case competition for undergraduates in the world.

We welcome you to browse the ACRC case collection. If you are interested in collaborating with the ACRC as an academic or a company, please contact Jeroen (jeroen@hku.hk) or Angela (ayin@hku.hk) and they will be able to provide you personalized advice. Happy browsing!

About Us

Established in 1997, Asia Case Research Centre (ACRC) addresses a growing demand for research and instructive materials relating to Asian business, and now boasts a repository of context-rich cases drawn from a vast range of industries and disciplinary areas. The Centre is committed to the advancement of learning and teaching in business education and strives to promote leading management thinking through research on the latest practices in the Asian business environment.

ACRC Recent Featured Cases

“Navigating the World of Cryptocurrency: Rising Opportunities and Regulatory Imperatives”

Bitcoin – Digital Gold Or A Fool’s Gold?

Authors: Dr. Rujing Meng and Taisy Chan

In the ever-shifting landscape of investments, the debate between tradition and innovation finds a new battleground: Bitcoin and gold. In this case, Mia, a wealth manager from Hong Kong, delves deep into the realms of Bitcoin and gold, dissecting their roles as currency hedges, inflation protectors, and portfolio diversifiers. Gold, with its timeless and tangible presence, stands as a beacon of stability, contrasting sharply with Bitcoin’s intangible nature and potential for rapid growth.

Students can glean insights into assessing risk, understanding investment instruments, and balancing portfolios. The importance of diversification emerges as a central theme, showcasing how incorporating alternative assets like Bitcoin and gold can mitigate risks and enhance overall portfolio performance. Moreover, institutional perspectives shed light on Bitcoin, offering valuable lessons in adapting to the evolving financial landscape.

The FTX Collapse: Due Diligence and Counterparty Risk Migration When Investing in Crypto Companies

Authors: Dr. Rujing Meng and Henri Arslanian

In the heart of the crypto market, FTX stood as a beacon of promise, captivating investors with its innovative approach and enticing prospects. However, the echoes of its collapse reverberated through the industry, leaving individuals questioning their due diligence practices and reevaluating counterparty risk. This case unravels the events leading to FTX’s downfall, shedding light on the critical importance of rigorous research and risk assessment when engaging with crypto companies. By exploring the series of events, the factors contributing to the collapse, and the missteps and oversights, readers can gain a deeper understanding of the intricate web of risks woven within the crypto investment sphere.

By analysing effective due diligence practices and strategies for mitigating counterparty risks, students learn to apply these insights in real-world scenarios. Through real-life examples and expert insights, students will be equipped with actionable knowledge, enabling them to make informed decisions and navigate the complexities of the crypto market. From enhancing due diligence protocols to embracing diversified perspectives, students can gain a comprehensive understanding of navigating the crypto investment landscape. Students can also explore the evolving regulatory landscape, offering insights into potential future developments and their implications in the crypto market.

“Financial Strategies Unveiled: Missteps by Big Business and Innovation for Small Business”

The realm of finance is a dynamic theater where strategies wield power, shaping the fate of enterprises both big and small. Join us as we navigate the intriguing world of financial management, delving into two captivating case studies that spotlight the perils of mismanagement in financial institutions and the innovative solutions fostering growth for small businesses.

Governance Lessons in Silicon Valley Bank’s Failure

Authors: Prof. Pingyang Gao, Dr. Xu Li, and Ramée Liu

Even the giants of industry can falter, and Silicon Valley Bank (SVB) serves as a stark alarm to the far-reaching implications of mismanagement. Once a cornerstone supporting tech startups and venture capital funds, SVB’s story unfolds as a cautionary tale of governance gone awry.

8 March 2023, marks a turning point when SVB’s attempts to enhance liquidity through equity and debt securities faltered catastrophically. The aftermath witnessed an unprecedented USD 42 billion exodus by depositors, leading to regulatory intervention, the bank’s shutdown, and the suspension of its shares on NASDAQ.

Further scrutiny reveals SVB’s ill-fated investments in long-dated securities, a decision that would prove disastrous. Categorized as Held-to-Maturity (HTM), these securities suffered unrealized losses of USD 15.1 billion by 31 December 2022, in stark contrast to the total equity of USD 16.3 billion. The chain reaction raised questions about financial stability and the role of governance in safeguarding institutions.

This cautionary tale underscores the pivotal role of governance and financial management within corporate giants. Students can glean essential lessons on the delicate balance between risk and stability. It emphasizes the importance of prudent investment strategies and transparent financial reporting, showcasing the far-reaching implications of mismanagement in the high-stakes world of finance.

Connecting Wall Street Capital with Main Street Small Businesses in China: The Case of Micro Connect

Author: Prof. Hongbin Cai, Prof. Hong Zou, Jiafang Yin, Jinming Xie

In the vast landscape of business, small enterprises often bear the brunt of financial challenges. Enter Micro Connect, a trailblazer in the world of small business financing. Established in 2021, Micro Connect embarked on a mission to empower small businesses in China through an innovative funding model. The founders, Charles Li and Gary Zhang, stand as architects of transformation, poised to reshape the financial landscape for small businesses.

Central to their strategy are daily revenue contracts (DRCs), a unique mechanism where businesses receive an upfront capital injection in exchange for sharing a portion of their daily revenue with Micro Connect. This symbiotic relationship not only fuels growth but also addresses the liquidity challenges faced by small enterprises. Micro Connect’s vision extends beyond borders, acting as a “super connector” that fuels micro and small businesses in China with sustainable sources from global capital. The Micro Connect Exchange amplifies this vision by providing a platform for small businesses to list their DRCs, offering investors a gateway to efficient capital deployment while enhancing liquidity and price discovery.

Micro Connect’s journey showcases the transformative potential of innovative financing models. Students can draw inspiration from their approach, understanding the importance of adaptability and creativity in financial solutions. It highlights the role of technology in bridging financial gaps and nurturing small businesses—a lesson that resonates beyond borders and industries.

In conclusion, the above two case studies, though distinct in nature, converge on the central theme of financial stewardship and innovation. They emphasize the significance of prudent management in avoiding catastrophe and the power of innovative financing to uplift economies. As students navigate the complex world of finance, these narratives serve as guideposts, offering wisdom from the past and inspiration for the future.

“Exploring the Application of AI in Finance and Accounting: Two ACRC Case Studies”

As we enter 2023, the world is witnessing the immense potential of artificial intelligence. OpenAI’s ChatGPT, an AI-powered chatbot, has taken the world by storm, and major tech giants are actively participating in the “AI arms race”. The evolution of AI has been ongoing for several years now, and it has already made significant strides in the business sector. In this article, we will delve into two cases published by the ACRC that demonstrate the practical application of AI in finance and accounting.

A Chairman’s Decision: Launching A Robo-Advisor in CCB Principal Asset Management Company

Authors: Dr. Rujing Meng and Fang Zhu

Robo advisory is a valuable application and innovation of artificial intelligence (AI) in the industry of asset and wealth management in the world. Despite its success in other markets, the development of robo advisors in China has experienced ups and downs. The case reviews the origin and development of robo-advisors in the U.S., Europe and Asian markets, and introduces the unique features of the investment management market in China. Thinking from the perspective of the chairman of CCB Principal Asset Management, Ltd. (CCB Principal), one of the top asset management companies in China, students are expected to identify the bottlenecks for the further development of robo-advisors in China, diagnose the advantages and challenges for CCB Principal to launch a robo-advisory service, and come up with a suitable business model for CCB Principal’s future strategies.

This case will enable students to comprehend the underpinning financial model of robo-advisors, analyze the advantages and constraints of robo-advisors compared with traditional human financial advisors, project the outlook for robo-advisors globally, and propose suitable strategies in China. The case also facilitates the learning of financial market and asset management industry in China and the role of AI in financial industry and innovation.

Artificial Intelligence in Accounting

Author: Dr. Xu Li, Ramée Liu

The case describes how Radial Tires Company (RTC), a tire manufacturer based in mainland China explored the use of AI technology to improve their accounting processes and reporting times. By implementing AI technology, RTC could increase productivity, improve accuracy in data input and processing, optimize revenue, and reduce costs. The use of AI could also assist with internal control, compliance, and auditing, as well as in making more informed management decisions.

This case allows students to learn about the practical applications of AI in the accounting practice and how it can improve productivity, accuracy, and efficiency for financial and management accountants. Students can explore the different types of AI-related tools and Robotic Process Automation (RPA) applications that are available in the market for office and accounting use in today’s business world. It highlights how AI and traditional automation can influence decision making in terms of management’s discretion in financial accounting and operations. Students can learn about the potential benefits of using AI in decision making, such as reducing the likelihood of human incentive-based manipulation, as illustrated in this case.

Green Finance and Innovative CSR:

BOCHK and Ant Financial Leading the Way

Consumers and businesses are increasingly aware of environmental, social, and governance (ESG) issues. This is where the concepts of green finance and corporate social responsibility (CSR) come into play. The following two ACRC cases highlight how businesses can integrate sustainable practices into their operations and create positive impacts.

BOCHK: Go Green with Banks, and with your Mortgages

Author: Dr. Sammy Fung, Kate Chung

This case illustrates how the Bank of China (Hong Kong) (BOCHK) developed a green mortgage scheme, the first of its kind in the local market. By leveraging sustainable finance concepts, BOCHK created a product that not only meets customer needs but also addresses environmental concerns. This case raises thought-provoking questions on how to roll out this initiative and extend the scheme’s coverage. It also highlights how companies can create synergies by developing ESG products and innovations.

Ant Financial and Its Innovative Corporate Social Responsibility

Author: Dr.Yanfeng Zheng, Dr. Qinyu Wang

This case showcases how Ant Financial, the leading Fintech company in China, created the Ant Forest project, which integrates social goals with business practices to create significant social impact and strategic value. This case stimulates discussions on popular CSR practices and their effectiveness and provides a framework to categorize different CSR practices based on their innovativeness and relationship to a firm’s core competence.

Through these two cases, students can gain a holistic and strategic view of green finance and CSR. They can learn how to apply practical finance knowledge to develop ESG products, evaluate different green finance standards, and analyze internal firm resources and external institutional environments to evaluate CSR initiatives’ effectiveness. They can also examine the competition between firms and non-profit organizations in delivering social goods.

Towards the world in uncertain economic times: IPOs of global conglomerates

The suspension of Ant Group’s Initial Public Offering (IPO) in 2020 was a watershed moment in the relationship between China’s regulators and the country’s Big Tech companies. Recently, Ant Group’s founder, Jack Ma announced he would relinquish control of Ant Group, which marks a key step forward in the fintech group’s restructuring process and an easing of tensions between Beijing and China’s Big Tech companies. As the external environment has turned cloudier, what will be the effect on the IPO activity of global companies?

HKU ACRC has published four cases that look at how the instability and uncertainty in various markets international markets affects the IPO application of the companies. These cases are suitable for teaching Finance & Investments courses at both the undergraduate and postgraduate/executive levels.

Next Capital: Leveraging Opportunities in the Hong Kong IPO Market

Author: Dr. Rujing Meng, Gianne Wong

This case introduces IPOs in Hong Kong from the perspectives of both issuers and investors. The case is set in the fourth quarter of 2020 when the Ant Group entered Hong Kong for its IPO. Students take on the role of Lin Wong, head of the investment team of a new investment fund under Next Capital Investment Limited, a leading independent Australian private equity firm.

This case explains the concept of IPOs from various perspectives, including the IPO process, the listing rules, the intermediaries involved, the requirements of corporate board structure, and disclosure in Hong Kong. It is suitable for teaching courses in investments, investment analysis and portfolio management, and international capital markets courses at both the undergraduate and postgraduate levels.

Ant Group: How the Largest IPO in History Came to a Halt

Author: Dr. Xu Li, Ramée Liu

In August 2020, the world’s largest fintech company, Ant Group was on course to raise HKD273bn in a dual offering on the Hong Kong Stock Exchange (SEHK) and the Shanghai Stock Exchange’s (SSE) STAR Market. To the surprise of many, this largest IPO in history was cancelled just two days before its scheduled listing because the Chinese central bank and regulators just issued new draft rules for online micro-lending. Ant was notified by the SSE that the company was unable to amend the disclosures in its IPO application to reflect the newly announced changes in legislation.

The case looks into Ant’s business development from digital payments to lending and other digital platform businesses. It will help students gain insights into the business model used by Ant in its lending business, as well as appreciate the business risks brought to the banking industry and the impact of regulations on its valuation. Students will be able to understand the accounting methods used by Ant for its lending business and use different methods to come up with the valuation of Ant as a digital platform and as a financial institution. It is suitable for teaching courses in finance and investment at both the undergraduate and postgraduate/executive levels.

WeWork’s Pre-IPO Value: USD47bn Or USD8bn?

Author: Dr. Xu Li, Ramée Liu

Despite very public ups and downs over the last few years, WeWork remains at the forefront of the shared workspace industry. WeWork was founded in New York in 2010 with a goal to offer coworking spaces to entrepreneurs, startup companies, freelancers, and even larger enterprises. The company grew rapidly since its establishment, making it one of the largest and most visible coworking chains in the world. When there seemed to be a bright path for the company, its failed initial public offering (IPO) of company stock challenged the capability of the company and it was described as “an implosion unlike any other in the history of start-ups”.

In September 2019, amid growing investor concerns over its corporate governance, valuation, and outlook for the business and the company co-founder Adam Neumann resigned from his position as CEO and gave up majority voting control in WeWork. WeWork formally withdrew its S-1 filing and announced the suspension of its IPO. At that time, the reported public valuation of the company was around USD 8 billion, a reduction from the USD 47 billion valuation it had achieved in January. As of May 2022, the company was traded at a valuation of USD 5 billion.

This case covers important valuation considerations, such as financial statement analysis, evaluation of a business model and corporate governance. Students will gain insights into the accounting treatment of leased properties and be able to analyze the profitability and business risk of the start-up.

Lufax: The Decision on Listing Venue

Author: Dr. Rujing Meng, Tsun-Kan Wan

This case explores the major considerations involved when choosing the most suitable listing market. In August 2020, Shanghai Lujiazui International Financial Asset Exchange Co Ltd, better known as Lufax, filed a confidential application to the US Securities and Exchange Commission for initial public offering in August 2020. The news stirred up heated discussions in the market, as Lufax was obviously of Chinese background. US-Sino relations had been experiencing more and more tensions. Even the US securities regulations had turned against US-listed Chinese firms. Amid this backdrop, is the US market the right choice for Lufax to go for an IPO? The market wonders if Lufax made a wise choice on the listing venue.

The case seeks to highlight the considerations of Lufax in deciding on a jurisdiction to be listed in. Every venue has its own listing requirements and should fit differently for firms with different intentions and characteristics. Through the case, students will grapple with the step-by-step practical questions concerning the comprehensive list of considerations for choosing the suitable listing market and conduct an analysis of the suitability of the US market as Lufax’ listing choice, compared to the market in Hong Kong and mainland China.

The path to continuing growth in the fierce e-commerce market

The world’s largest annual retail event, “Singles Day”, also known as Double 11 in China, has achieved great success in the past decades. In 2021, shoppers spent a record of more than RMB952 billion (USD134 billion) on online transactions. This year, Alibaba and JD.com keep full sales results under wraps for the first time in the shopping festival’s history and reported that the result is in line with the performance of 2021. It could be an indicator hinting that macroeconomic headwinds could be hitting the region and the e-commerce sector. Amid this changing environment, how can e-commerce giants like Pinduoduo and Meituan continue growing?

HKU ACRC has published two cases on these two companies, both cases are suitable for strategy & general management courses at both the undergraduate and postgraduate/executive levels.

Pinduoduo: 300+ Million Shoppers Teaming for Good Deals

Author: Prof. Kevin Zhou, Josephine Lau

Pinduoduo (PDD) is an e-commerce platform backed by Tencent. It offers a wide range of rock-bottom-priced products from home appliances to daily groceries. Its key differentiator from other Alibaba’s Taobao and JD.com is it’s ‘team purchase’ model. Pinduoduo users can invite friends and family on social media to join a group deal in order to generate discounts.

In July 2018, PDD successfully raised USD1.63bn in an initial public offering (IPO) in the US, making it one of the biggest US listings by Chinese firms in the previous four years. Established for less than three years, Pinduoduo represents the most successful example of how a mobile commerce app can be designed from the ground up to engineer social sharing, viral engagement, and repeat buying as part of the user experience. As the company enters its post-IPO era, the strategic options for PDD to sustain its growth have caught public attention.

This case provides insights on the latest development and emerging concepts in China’s retailing, business, and technology models in e-commerce. Students will be able to place themselves in the shoes of a Chinese e-commerce startup and explore the Blue Ocean Strategy to excel in the competitive marketplace. It also allows students to analyze the opportunities and challenges associated with a Chinese e-commerce startup.

Meituan Dianping: China’s Super Service App

Author: Dr. Wen Zhou, Jeroen van den Berg, Jienan Han

Meituan is China’s largest one-stop online platform for goods and services on-demand, from dining to mobility, with over 130 million annual active purchasers. Since its formation in the 2015 merger of Meituan and Dianping, its range of services and valuation has ballooned. Meituan currently operates its businesses through three business units: Customers to Shop, Hotel Tourism, and Home Delivery Service. During the COVID-19 pandemic period, Meituan surged by 58.7 million active users in the first quarter of 2021, a historical high.

This case chronicles the strategies Meituan taps to reach consumers and facilitate brand growth in China’s hyper-competitive e-commerce industry. It provides insights on Meituan’s market strategy in several live-or-die competitive battles including the so-called “Thousand Groupon War”. To sustain long-term growth in the fast-evolving market, the next strategy for Meituan is critical.

This case explores the competitive strategies in online-to-offline businesses, including Judo strategy, platform strategies, and collaborative strategies. It provides insights on the pros and cons of tech-driven platforms compared with “traditional” businesses. Students will be able to explore ways to maximize the value of the platform ecosystem, as well as apply Metcalfe’s law to understand value platforms.

Opportunities & Challenges in Global Supply Chains

Supply chain management (SCM) is key to maximizing company profit and minimizing product defects. The SCM requires active management because the process involves every aspect of business operations. It integrates materials, finances, suppliers, manufacturing facilities, wholesalers, retailers, and consumers into a seamless system.

iPhone’s Supply Chain Under Threat

Author: Dr. Benjamin Yen, Dr. Minyi Huang

The outbreak of COVID-19 posed unprecedented challenges to global supply chains. As a leading and innovative supply chain that achieved just-in-time manufacturing, Apple’s performance was put in the spotlight.

This case describes how Apple’s supply chain has coped with the COVID-19 pandemic. The pandemic brought both challenges and opportunities to Apple. On one hand, the social distancing measures have slowed the manufacturing process and reduced the demand of the customers. On the other hand, social distancing boosted the demands for electronic devices, attributed to the work-from-home culture.

Through this case, students will understand the importance of risk management in supply chain management and learn the challenges and opportunities of the disruption posed to business operations. The case provides an opportunity for students to understand the importance of resilience in supply chain management and discuss different strategies to cope with unexpected disruptions in supply chain management.

China Moves Up the Value Chains: Foxconn’s Dilemma

Author: Prof. Heiwai Tang, Dr. Minyi Huang

Foxconn (Hon Hai Precision Industry), the world’s biggest maker of electronic components and a major supplier to Apple, is facing supply and demand challenges.

This case describes and examines the challenges affecting Foxconn’s operations and its strategies to respond to them. Among the challenges, China’s lockdown during the pandemic and the US-China trade war have a very significant impact on reshaping global value chains.

This case provides insights into the risks of global value chains. It allows students to discuss how global value chain restructuring affects a company, especially during the US-China trade war and the COVID-19 pandemic. It provides an opportunity for students to explore corporate strategies to cope with supply chain restructuring.

Can Blockchain Help Château Lafite Fight Counterfeits?

Author: Dr. Benjamin Yen, Dr. Minyi Huang

Counterfeiting in the fine wine industry is rampant. Fighting the counterfeiters has proven difficult for wineries as the traceability in the wine supply chain is insufficient and stakeholders have different interests and capabilities in identifying fake wine. Chateau Lafite Rothschild, which produces some of the world’s most expensive wine has also attempted to deal with wine counterfeiting by adopting advanced technologies such as barcodes, Quick Response Codes (QR codes), Radio Frequency Identification (RFID), Electronic Product Codes (EPC), and blockchain.

The case examines the benefits and limitations of using different advanced technologies, especially emerging blockchain technology, to improve traceability in the supply chain. On one hand, Lafite could potentially track a wine bottle’s entire lifecycle, from grape harvest to sale, and store that information on the blockchain. It could also reduce the labor cost to store the information. On the other hand, the expense of using blockchain has also been taken into account.

Students will learn how to assess the feasibility of using advanced technologies in supply chain management. It provides the opportunity for students to examine the benefits and limitations of applying different technologies in supply chain management, especially blockchain technology.

The Future of Business and Human Rights: Cases across Three Different Industries

Business touches the lives of people in diverse ways, from workers to customers to community members throughout global value chains. The actions of business enterprises can affect people’s enjoyment of their human rights either positively or negatively. Although we can see enormous changes in the business and human rights landscape, still, some businesses are under increased public scrutiny for their human rights footprint.

Patagonia: Tackling Human Trafficking in Global Supply Chains

Author: David Bishop, Kalina Milenova

Patagonia, an American retailer of outdoor clothing based in California, with a strong commitment to using business to protect nature. It was featured in the press because of a human rights scandal within their manufacturing chain. They’re not the only brand to become involved in such scandal, but unlike many of their competitors involved in similar situation, Patagonia whistle blew their scandal and launched multiple initiatives to promote environmental protection and human rights.

This case is based on Patagonia’s journey to eliminate human trafficking and forced labor from their supply chain. The case takes students through Patagonia’s discovery of forced labor and debt bondage amongst their suppliers in Taiwan and later in Thailand.

Through this case, students will study a real-life example of a company’s unique approach to tackling issues of human trafficking, forced labor and debt bondage in their supply chain. Students will be able to place themselves in the shoes of Patagonia’s Social and Environmental Responsibility (SER) team and analyse the benefits and drawbacks of different approaches to eliminating human trafficking and forced labor from their suppliers’ practices and creating industry-wide change.

Big Chocolate: Child Slavery in the Cocoa Industry

Author: David Bishop, Jamie Chan

Swiss cocoa giant Nestlé has been at the center of multiple lawsuits and investigations, accused of aiding and abetting the enslavement of child labourers on cocoa plantations in West African countries since the 1990s.

This case explores the complex and pervasive issue of child labour in the global cocoa supply chain. In 2015, The Swiss Coalition for Corporate Justice (SCCJ), an alliance of Switzerland-based NGOs, launched the Responsible Business Initiative (RBI) campaign. The proposed initiative aimed to introduce legal requirements for companies to undertake human rights and environmental due diligence under the Federal Constitution. Yet, despite multiple initiatives taken by Nestlé to reform its supply chain, the child slavery problem persists.

This case provides insights on the persistence and prevalence of modern slavery risks in the cocoa supply chain. Students will be able to evaluate the effectiveness of initiatives to introduce corporate accountability in the cocoa sector, including certification, legislation, policy, and cocoa companies’ own initiatives.

Social Auditing in Global Supply Chains: Forced Labor in the Malaysian Rubber Glove Industry

Author: David Bishop, Jamie Chan

During the COVID-19 pandemic, thousands of rubber glove factory workers in Malaysia tested positive for the virus. It has reignited discussions and investigations of human rights issues in the factories. Aguila Safety Group (ASG), a prominent UK-based personal protective equipment (PPE) procurement company is one of the companies under public scrutiny for the issue of forced labour.

This case is written from the perspective of Ting-ting Loh, CEO of ASG. It describes how Ting-ting makes decisions to address the allegations of forced labour in ASG’s supply chain while continuing to meet demands for medical supplies during the pandemic.

This case provides insights on the risks and processes of forced and bonded labour in global supply chains. It also suggests ways for companies to respond to modern slavery risks and increase transparency in transnational supply chains using ESG principles. Students will be able to evaluate the effectiveness of social audits in increasing supply chain transparency.

Leveraging Digital Channels: Cases of two retail giants

Shein: An Ultra-Fast-Fashion Retailer’s Digital Strategies

Author: Prof. Yukfai Fong, Prof. Zhixi Wan and Dr. Minyi Huang

In recent years, shoppers have witnessed the rapid rise of Chinese brands, especially Shein, an ultra-fast-fashion brand with an estimated value of USD100bn in 2022. Shein offers a huge range of low-priced and ever-changing fashion appeal to Gen-Z. Recently, the group has taken a number of initiatives to strengthen its global presence, which include hiring a new development director to take charge of its expansion in Europe and cooperating with China Southern Airlines Logistics to expand its warehousing resources.

This case study illustrates the reasons that contributed to the success of Shein, which include using big data and algorithms to identify customers and their preferences. It also describes the challenges that Shein has faced during its efforts to develop a sustainable business. It has been accused of low quality, copyright infringement, and encouraging a culture of excessive consumption.

This case provides insights on the importance of network effects for a platform business model and the implications for core competence. It allows students to analyze the benefits and risks of cross-border supply chain management and the competitive advantages of a firm. It is suitable for teaching ESG and strategy & general management courses at both the undergraduate and postgraduate/ executive levels.

Procter and Gamble in China, 2022

Author: Prof. Michael Enright

Since the beginning of the pandemic, China’s market for FMCG is undergoing tremendous change. Certain major cities in China started locking down in March and April, which has accelerated the shift from traditional sales channels to online sales. This has brought opportunities for niche and private-label brands to share the market using digital channels.

This case study introduces the market positioning and business model of Procter & Gamble (P&G), one of the world’s largest consumer goods companies. In order to respond to the changing environment, P&G needs to rethink its strategy in China and make good use of the new opportunities, such as digital channels.

This case covers the following learning objectives:

1. Advantages and disadvantages of broadline versus focused competitors

2. Advantages and disadvantages of global scope versus local knowledge

3. Global integration versus local responsiveness in international business

4. Importance and opportunities associated with e-commerce

Students will also gain a deeper understanding of China’s business environment and strategy. It is suitable for teaching strategy & general management courses at both the undergraduate and postgraduate/executive levels.

Evergrande: Accounting for Embedded Derivatives

Author: Dr. Xu Li, Tsun-Kan Wan

Can you imagine the debt of a company equal to the GDP of Pakistan, a country of 220 million people? What would happen if such a company would fail?

“Evergrande: Accounting for Embedded Derivatives” explores the accounting treatment for embedded derivatives of China Evergrande Group, the largest property developer in China. The firm is suffering under an enormous pile of debt, reportedly worth US$305 billion.

On 24 September 2020, a “letter” was widely circulated on the Internet. This letter brought a potential liability of RMB130 billion to the attention of investors and the general public including those who had made deposits for homes under construction by Evergrande. Although Evergrande officially rejected the authenticity of the letter, credit rating agency S&P downgraded its credit rating to “negative” on the following day.

This case provides insights on the difference between traditional derivatives and embedded derivatives. It allows students to discuss the use of the Binomial Lattice Model to value derivatives. Students learn about the accounting treatment of non-controlling interest (NCI) calls and puts. The case is suitable for teaching accounting & control courses at both the undergraduate and postgraduate/executive levels.

Wirecard’s Multibillion-Dollar Fraud: Who Should be Blamed for the Corporate Governance Failure?

Author: Dr. Sammy Fung, Tsun-Kan Wan

The collapse of Wirecard AG, the once largest German fintech group by market capitalization, shook markets globally. Wirecard crashed in June 2020 after admitting that EUR1.9bn supposedly held in bank accounts in Asia did not exist. The downfall of the group damaged the image of Germany as a financial center and brought the quality of EY’s audits into question. It also revealed that accounting scams, tax evasion, and crypto crimes can hide in plain sight.

This case explores how Wirecard could have concealed its fraudulent accounting practices for more than a decade. It allows the reader to assess the accountability of different parties to the corporate governance failure, namely the management, board of directors/supervisors and audit committee, external auditors, and regulators.

This case provides insights on the relationship between the multinational-outsourcing business model and its vulnerabilities to fraud. Through the case, students will grapple with the practical questions of how to understand and evaluate the effectiveness of corporate governance of a large-scale organization in a global setting. It is suitable for teaching accounting & control courses at both the undergraduate and postgraduate/executive levels.

PayMe: Hong Kong’s e-wallet

Author: Dr. Tingting Fan, Suresh Balaji, Ingrid Piper

In Hong Kong, when people have no cash with them, they may ask “Can I PayMe you?”. Throughout the past five years, the HSBC-backed payment app PayMe has changed Hong Kong consumers’ habits of paying with cash or checks. Now there are 2.6 million PayMe users in Hong Kong. Despite the initial success of PayMe in the peer-to-peer (P2P) market, it is facing several challenges as it continues to look to expand.

“PayMe: Hong Kong’s e-wallet” introduces the market positioning and business model of PayMe, as well as its challenges. One such challenge is the competition with nonbanking financial institutions, such as Alipay and WeChat Pay, two of the largest mobile payment platforms in Hong Kong. Another is the need to get more local merchants to accept PayMe.

This case allows the faculty to discuss the difference between target market and target audience. Students can explore and discuss consumer behaviour to understand how a successful business model that works in one place can be transferred to another. It is suitable for teaching marketing, strategy & general management courses at both the undergraduate and postgraduate/executive levels.

ESG at WeChat Pay to Support SMEs

Author: Dr. Shan Huang, Dr. Shipeng Yan, Prof. Zhenhui Jack Jiang, and Dr. Minyi Huang

COVID-19 has brought new challenges and has aggravated the plight faced by small and medium-sized enterprises. In China, SMEs account for about 90 percent of firms and 80 percent of all jobs, and they contribute more than 60 percent of GDP in the country. WeChat Pay, one of the leading mobile payment platforms in China, is stepping up its ESG efforts to support the SME sector in order to facilitate financial inclusion.

“ESG at WeChat Pay to Support SMEs” illustrates the challenges that WeChat has faced during its efforts to develop technologies that can meet the various needs of SMEs. The challenges include payment method, business management, and merchant security assurance.

This case provides insights on the importance of including ESG strategies for a company and the implications for corporate management. It leads students to identify the pain points of working with SMEs and to suggest IT solutions that potential users will accept, as well as value-added ESG initiatives for the companies. It is suitable for teaching ESG and strategy & general management courses at both the undergraduate and postgraduate/executive levels.

Cainiao’s Sustainable Packaging Challenges

Author: Dr. Benjamin Yen, Minyi Huang

When you are unboxing a parcel, what can you find inside? Excitement? Happiness? Yes, but also different types of packaging material. Usually, the amount of packaging used to protect goods is more than what is needed to reduce the risk of damage during transport. As the public becomes more environmentally aware, e-commerce companies are under pressure to achieve sustainable packaging. Cainiao, the logistics arm of e-commerce giant Alibaba, is thus striving to foster a greener and more sustainable logistics ecosystem.

Based on the business of Cainiao, this case addresses the importance and challenges of sustainable packaging and calls on all stakeholders in the supply chain to work together. It also highlights how different business models may determine different ways of managing sustainable packaging. For example, JD.com, the largest online retailer in China, rolled out a “Green Flow Plan” to replace cardboard boxes with recyclable plastic boxes and replaced the sealing tape with a self-locking buckle. As the business models of Cainiao and JD.com are different, they have different considerations in their sustainable strategies.

The case can be used to provide insights into the viewpoints of different stakeholder groups in the supply chain when formulating environmental sustainability strategies, as well as the environmental, social, and economic impact of sustainable packaging strategies.

Royal Dutch Shell and Beyond: Strategizing the Future of ESG Compliance

Author: Dr. Agnes Chong

Climate change is now a fact of political life and it has big implications for individuals, businesses, and policymakers. Mobilizing a critical mass of business leaders to implement climate change solutions is made more challenging when they each have their own commercial considerations.

The legal judgment against oil giant Royal Dutch Shell set a precedent for similar lawsuits against energy companies across the globe. It has put pressure on the industry to shift away from fossil fuels and ramp up investment in renewables to avoid legal risks.

Apart from Royal Dutch Shell, this case also covers other examples of green initiatives, including successful shareholder activist campaigns at Chevron and Exxon, and regulators’ scrutiny of listed company climate disclosures.

The case highlights pressures from regulators and the courts in enforcing emissions reductions more strictly than previously and the greater litigation risk that corporations will face going forward. It also covers the interests and pressure of the shareholders and senior management in advocating the climate policy in their corporations.

The case encourages discussion of corporate strategy, risk management, public relations, and investor communications in the context of ESG issues and aims to broaden students’ conceptual framework of these key issues.

Leading the Marriott Way

Author: David S. Lee

The coronavirus pandemic is a crisis unlike any other in recent times. What business leaders need during the crisis is not a predefined response plan but behaviours and mindsets that will prevent them from overreacting to yesterday’s developments and help them look ahead. Marriott International, the world’s largest hotel operator, has been at the centre of the turmoil caused by the pandemic. Yet it is showing the green shoots of recovery under great leadership.

The case introduces the leadership journey of Craig Smith, Group President and Managing Director of Marriott International. In this role, he is responsible for Marriott’s operations outside of North America. Craig has been with Marriott for over three decades. With an impressive and well-travelled career, Craig is widely known as an influential leader in the hospitality industry. He has demonstrated authentic leadership in crises, including the Indian Ocean tsunami of 2004 that swept away entire communities around the Indian Ocean. At that time, Craig was the general manager of the Marriott resort on Thailand’s tropical island of Phuket, he helped galvanize the resort staff and provided them clear purpose amid the crisis.

The case can be used to provide insights on the importance of inculcating a strategic perspective in planning and developing one’s career. It highlights examples of authentic leadership and servant leadership.

Redress: Creating a Sustainable Movement for change in Fast Fashion

Author: Prof. Chun Hui, Dr. Shujuan Xiao, Ingrid Piper

‘Fast fashion’ dominates the global fashion landscape, but the immeasurable cost to the environment often goes unnoticed. According to the World Economic Forum, 85% of textiles manufactured are dumped into landfills, while overproduction of textiles resulted in 92 million tonnes of textiles being wasted every year. Redress was born in this context. It aims to encourage consumers, the fashion industry and manufacturers, to take a more sustainable approach to garment and textile manufacturing.

The case introduces the market positioning and business model of an environmental charity Redress. Redress partially achieves its aims through clothing drives, redistribution of garments, and pop-up stores. While these events generate income, they also place a financial burden on the charity in terms of logistics, cost of storage, and training of volunteers.

The case can be used to teach social entrepreneurship how it can be used to develop sustainable solutions. It also allows for a discussion on the concept of value and the importance of personal value to the workplace.

Credit Risk Modeling Using Non-traditional Data: The Experience of Ping An OneConnect Bank

Author: Prof. Chen Lin, Prof. Hong Zou, Dr. Yanfeng Zheng, and Tsun-Kan Wan

The introduction of virtual banks in Hong Kong has improved the services enterprises have access to. But only a few virtual banks focus on small companies. According to research by Support and Consultation Centre for Small and Medium Enterprise (SUCCESS), Hong Kong is home to over 340,000 small and medium enterprises (SMEs), accounting for more than 98 percent of business establishments, yet the traditional lengthy process of opening bank accounts and loan application creates financial hurdles for these SMEs. Ping An OneConnect Bank (PAOB) was born in this context. It aims at helping SMEs fill the financing gaps with technology.

The case introduces the market positioning and business model of the newly established virtual bank Ping An OneConnect Bank (Hong Kong) Limited (PAOB). PAOB is a pioneer in leveraging Fintech to provide efficient banking services to both SMEs and retail customers. The bank uses innovative credit risk and loan pricing models that rely on big data analytics, including detailed customs data for its small and medium-sized enterprise (SME) customers in the import/export business.

The case can be used to provide insights on the role of Fintech in enhancing financial inclusion, as well as the relations between traditional banking and Fintech startups, and the risk and challenges that Fintech startups create for traditional banking.

Recent Events

International case teaching & case development online workshop

On August 25-27, 2022, the Asia Case Research Centre (ACRC) and All India Management Association (AIMA) co-organized a three-day International Case Teaching & Case Development Online Workshop for educators from India, Hong Kong China, and Vietnam. This was also the very first time the ACRC had a hybrid session in collaboration with the HKU Business School faculty teaching retreat.

The workshop aimed to provide insight into the dynamics of the case method, suggest tools and techniques for teaching with cases in the classroom, as well as develop and publish your own cases. The participants were able to participate in a wide-range of sessions including a mock case class, a case development exercise, and a sharing session with leaders from different industries.

On day two, David S. Lee, Principal Lecturer of Accounting and Law and a multi-award-winning teacher shared his case “Diversity in a Global Context: Making the Right Hire to Lead Asia”, published by the ACRC and in the May-June edition of Harvard Business Review. This case is inspired by an actual experience at a North American toy company. It focuses on the CEO’s hiring decision, which requires him to interpret and grapple with what diversity means in a more global, non-Western context and make a decision between two very qualified candidates. The original case is available on the ACRC website: https://www.acrc.hku.hk/Case/Detail/1088

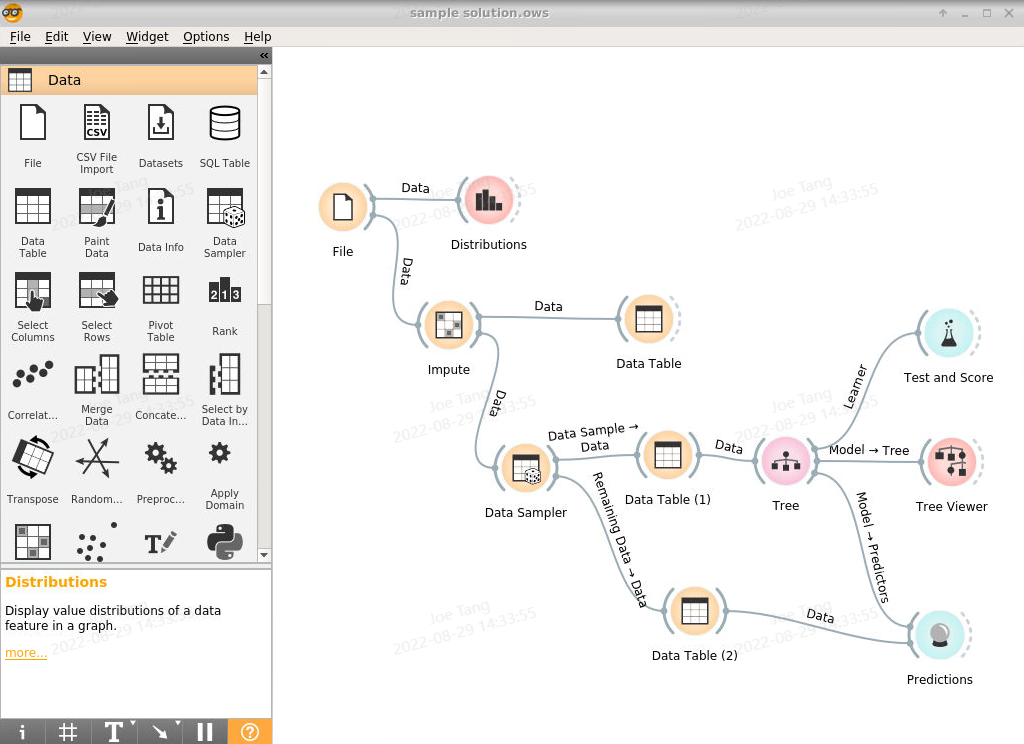

On day 3, Dr. Tuan Q. Phan, Associate Professor of Innovation and Information Management and Marketing, shared his rich experience in teaching data analytics and big data at all levels. He proposed a top-down instead of a bottom-up approach in teaching data analytics, starting with teaching relevant case studies and the application of real data, before teaching students how to write algorithms, code, or teach them mathematics.

On the same day, the ACRC colleagues showcased the world’s 1st cloud-based platform for data analytics cases being developed by the ACRC. The platform will be launched internally in Fall 2022. Stay tuned!

To learn more about upcoming ACRC events, please follow us on LinkedIn:

https://www.linkedin.com/company/asia-case-research-centre-acrc/

ACRC developing the world’s first cloud-based platform for data analytics cases

Data has always been at the heart of corporate decision-making, and analysis by computers and algorithms is deeper and broader than ever before. As a result, the demand for data analytics across industries is increasing. As educators, our responsibility is to train the next generation of business leaders and strengthen their ability to adapt to this rapidly changing environment. In order to continuously raise the bar, ACRC is developing the world’s first cloud platform for data analysis cases.

The DAP will achieve important goals including:

- Facilitate the teaching of (big) data analytics to students with a wide range of needs and competences

- Bring real-life business practice in the area of data analytics into classroom,

- Give students hands-on experience in identifying and addressing real-life business challenges and opportunities through the use of (big) data analytics.

The platform is currently in development, with an internal launch planned for the fall 2022 semester and a global rollout for the spring 2023 semester. To know more about the ACRC, please follow our LinkedIn:

https://www.linkedin.com/company/asia-case-research-centre-acrc/

24 teams from across the globe competed in the world’s largest case competition for undergraduates!

The “The HSBC/HKU Asia Pacific Business Case Competition 2022” concluded on June 2 after three days of online presentations by 24 teams of university students from different parts of the world. The University of Malaya won the competition with the University of Toronto and Shaheed Sukhdev College Of Business Studies taking 1st and 2nd runners up respectively.

Over the past 15 years, the ACRC has organized the competition, aiming to educate and nurture young leaders. It has become the world’s largest business case competition for undergraduate students. The competition bridges academia with real-world business challenges.

Three newly released ACRC cases were used in the three rounds of the competition respectively. Students presented their solutions to a panel of executives from HSBC.

Round | Case | Author | Link |

1 | ESG at WeChat Pay to Support SMEs | Dr. Shan Huang, Dr. Shipeng Yan, Prof. Zhenhui Jack Jiang, and Dr. Minyi Huang | |

2 | Porsche Taycan: Service Failure and Recovery | Prof. Bennett Yim, and Josephine Lau | |

3 | PayMe: Hong Kong’s e-wallet | Dr. Tingting Fan, Suresh Balaji, and Ingrid Piper |

Featuring Female Protagonists in Case Studies

The qualities of a great leader have never been gender-dependent. According to United Nations, as of 1 September 2021, there are 26 women serving as Heads of State and/or Government. In the academic year 2020/2021, the male-to-female student ratio in HKU Business School is 46:54. Now that we are in 2022, we can see that global companies are making rapid progress in getting more women into senior leadership roles. It is essential to have case studies featuring women protagonists who can serve as role models, and motivate female students to achieve their dreams when it comes to their future careers. To eliminate the gender gap and promote diversity, the ACRC has always strived to feature a diverse mix of protagonists in our case studies.

“Food Angel: A Sustainable Solution to Food Waste in Hong Kong”, authored by Prof. Chun Hui and Ingrid Piper is one of the ACRC cases featuring a female protagonist. Gigi Tung is the founder of the food rescue and food assistance programme “Food Angel”. The programme collects edible surplus food from local food suppliers and turns it into nutritionally-balanced hot meals, which are distributed to underprivileged communities in Hong Kong. The case demonstrates the thinking and decision-making process of Gigi in a social venture, including the establishment of an organizational culture.

“Snapask in Indonesia” is authored by Dr. Tuan Q. Phan and Dr. Estela Ibanez-Garcia. The case features Katherine Cheung, Chief Marketing Officer of education technology company Snapask. The company applies machine learning and mobile cloud services to make education more effective, personalized, and accessible to everyone. The case demonstrates the ability of Katherine in leading Snapask’s entry into different markets across the Asia-Pacific.

We will introduce more cases featuring a diverse mix of protagonists on our LinkedIn page: https://www.linkedin.com/company/asia-case-research-centre-acrc

Stay tuned!

The cases are both available on the ACRC website:

“Food Angel: A Sustainable Solution to Food Waste in Hong Kong”:

https://www.acrc.hku.hk/Case/Detail/1048

“Snapask in Indonesia”:

https://www.acrc.hku.hk/Case/Detail/1106

Case Coaching and Case Solving Workshop Recap: Learn from the best and become one yourself!

In May 2022, the ACRC held a series of online Case Solving and Case Coaching Workshops with experts in the area. The purpose of the three-parts Case Solving Workshop was to teach students how to solve and present case studies. The Case Coaching Workshop taught faculty how to solve cases and transfer case solving skills to their students.

On 3, 9 and 17 May, the ACRC held a three-parts Case Solving Workshop in collaboration with Prof. Vesna Damnjanovic, the founder of the Belgrade Business International Case Competition. During the workshop, Prof. Vesna shared her insights on case solving. Each workshop focused on a specific issue of the case solving process, including how to effectively read and understand the case study challenge, and train the participants in the various aspects of case solving.

On 4 May, the ACRC also held an online Case Coaching Workshop, led by an experienced case trainer. The speaker took the participants through the basics of the case method, case solution fundamentals, and the topic of how to coach a team.

Our workshops for students can be found here:

https://competition.acrc.hku.hk/About/LearningResources

To learn more about upcoming ACRC events please follow us on LinkedIn:

https://www.linkedin.com/company/asia-case-research-centre-acrc

A real-life business case on diversity, equity, and inclusion

Exciting news to share! The case “Diversity in a Global Context: Making the Right Hire to Lead Asia” authored by David S. LEE was published in the May-June edition of Harvard Business Review.

This case is inspired by an actual experience at North American toy company. It focuses on the CEO’s hiring decision, which requires him to interpret and grapple with what diversity means in a more global, non-Western context and make a decision between two very qualified candidates. The decision is strategically important to the company as this senior person will lead the company’s Asia business.

If you were the CEO of an international company with a mostly white-male board. When hiring a key position for business expansion in China, would you choose a white American male who is fluent in Mandarin and who has strong business relationships in China, or an American-born Chinese woman who excels in business consultancy with a network in Asia but conversational spoken Mandarin only?

The original case is available on the ACRC website:

https://www.acrc.hku.hk/Case/Detail/1088

The Harvard Business Review Article including two expert insights with opposing views on the person to hire can be found here:

https://hbr.org/2022/05/case-study-what-does-diversity-mean-in-a-global-organization?ab=at_art_art_1x1

HKU and CityU to represent Hong Kong in the HSBC/HKU Asia Pacific Business School Competition

The “HSBC/HKU Hong Kong Business Case Competition 2022” concluded on March 8 after two days of online presentations by 9 university teams. Congratulations to all winners of the Hong Kong Business Case Competition!

HKU has been partnering with HSBC to organise this competition for 15 years, with an aim to nurture young leaders. This year, participating teams were required to analyse and solve the business cases “Redress: Creating a Sustainable Movement for change in Fast Fashion” co-authored by Prof. Chun Hui and “Snapask in Indonesia” co-authored by Dr. Tuan Quang Phan. The cases covered some of the most relevant topics in business, namely ESG and how to make the fashion industry sustainable, and Edtech and how a Hong Kong unicorn can penetrate overseas markets leveraging its innovative use of technology. Both cases are available on the website of the Asia Case Research Centre: https://www.acrc.hku.hk/.

Students presented their solutions to a panel of executives from HSBC and the Case Company.

During the award ceremony, hosted by Leanne Lim, Chief Executive Officer at HSBC and Professor Hongbin Cai, Dean of HKU Business School, Professor Cai expressed, “I believe students will sharpen their essential skills through this journey, empowering them to excel in the new digital age.”

We look forward to seeing the team from HKU Business School and City University of Hong Kong represent Hong Kong in the global finals of the world’s largest business case competition for undergraduate students, from 24 May to 2 June this year.